5 Key Tips to Help Prepare Your Law Firm for 2026

With another busy year nearly behind us, many firms are turning their attention to their finances and planning ahead. With the right approach, 2026 can be a year of clarity, control, and growth, rather than stress over cashflow or reconciliations.

Understanding where your money comes from and where it goes is the foundation of financial health. At year-end, it’s essential to review balances, invoices, and outstanding receivables so you have a complete picture of your firm’s finances.

Imagine a mid-sized law firm that wraps up December with a few large invoices still unpaid. Without visibility, they might assume they have cash available for planned investments in staff training or technology upgrades, but those funds won’t arrive until January. By reviewing the year-end balances and aged debt, the firm can spot potential shortfalls, plan accordingly, and avoid unnecessary stress in the new year.

Seasonal fluctuations are another important factor. Many law firms see slower payments over the festive period or early January. Knowing this in advance allows you to plan for temporary shortfalls, adjust costs, or delay discretionary spending without disrupting operations.

Tip: Regularly forecast cashflow over the next 3–6 months. Planning around predictable payment delays or seasonal slowdowns ensures no surprises at the start of the year.

Not all areas of a law firm contribute equally to profitability. Taking the time to analyse which departments, practice areas, or individual matters performed best in 2025 can uncover valuable insights and highlight areas for improvement.

A firm may see that the corporate team generates higher revenue per matter, while the conveyancing team handles larger volumes but with slower payment cycles. On closer analysis, they may see that certain conveyancing processes are slowing down revenue recognition or increasing overheads. With this knowledge, the firm can make targeted changes, streamlining workflows, adjusting staffing levels, or investing in training to improve overall efficiency and profitability.

Similarly, reviewing matters individually can reveal where time is being spent versus revenue earned. Perhaps smaller matters are consuming disproportionate staff hours, or some types of cases consistently underperform due to delayed billing or longer payment cycles. These insights allow firms to make informed decisions on pricing, process improvements, or resource allocation.

Tip: Use your data to make smarter allocation decisions in 2026. Whether that’s reallocating staff to high-performing areas, adjusting marketing to target more profitable case types, or investing in technology that speeds up workflows, a clear understanding of past performance ensures you start the new year with both efficiency and profitability in mind.

Efficient processes save time, reduce errors, and make operations smoother. Reviewing reconciliations, billing, and reporting processes at year-end ensures everything is accurate and consistent.

Some firms find that month-end reconciliations take longer than expected due to manually tracking receipts across multiple accounts. Standardised workflows and automation tools, like the Cashroom Portal, reduce errors, save staff hours, and give partners a clear view of finances. Even simple adjustments, such as consistent invoice templates or clear approval steps for expenses, can prevent January headaches and ensure a smoother start to the year. At Cashroom we reconcile bank accounts daily – no exceptions!

Tip: Conduct a mini “process audit” before the new year. Reviewing last year’s billing cycle might reveal recurring delays caused by unclear approval paths. Making small tweaks, like assigning responsibility for approvals or introducing automated reminders, can significantly speed up operations in 2026.

Ambitious targets are important, but flexibility is equally essential. Unexpected costs, client delays, or market shifts can impact even the best-laid plans. Planning for growth while leaving room for adaptability ensures the firm can respond quickly without compromising cashflow.

Careful cashflow projections help determine whether planned hires, investments, or other expenditures are feasible in early 2026. Scenario planning, such as modelling delays in key client payments or accelerated growth in certain practice areas allows proactive adjustments in staffing, marketing, or investments, keeping operations stable.

Tip: Strong planning is not predicting the future, it means preparing for it. Combining realistic targets, data-backed decisions, and contingency plans ensures your firm starts the new year agile, resilient, and ready to succeed.

Billing practices directly impact cashflow, client satisfaction, and revenue collection. Reviewing how quickly invoices are issued, how clear they are, and whether clients are set up for convenient payment methods can make a big difference.

Firms may discover delays caused by complex billing approvals, unclear descriptions, or manual processes. Simplifying invoice layouts, implementing electronic invoicing, or offering multiple payment options can reduce delays and improve collections. Tracking overdue invoices regularly ensures issues are addressed promptly rather than accumulating over time. Our credit control service actively monitors overdue invoices, helping firms chase outstanding payments efficiently and maintain a healthy cashflow.

Tip: Optimising billing isn’t just about speed; it’s about consistency and clarity. A streamlined approach improves client experience while keeping cashflow predictable for the firm.

Start the 2026 with Confidence

Strong financial foundations lead to stronger firms. To help law firms like yours, we’ve created a practical guide: 10 Simple Ways to Manage Your Law Firm’s Cash Flow. It’s packed with actionable tips to help you start 2026 with control and confidence.

Interested in a confidential chat?

If you are considering outsourcing your legal cashiering, or just want to find out how it works, our team is here to help.

Cashroom provides expert outsourced account services for law firms including legal cashiering, management accounts and payroll services. Our mission is to fee lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

“I’ve been a client of Cashroom for over 10 years and couldn’t fault the service. When I started the firm, I had basic knowledge of compliance and bookkeeping but didn’t feel confident managing it myself. Cashroom took that weight off my shoulders and provided an invaluable resource I wouldn’t have been able to afford in-house.”

meaningful. This recognition reflects the company’s ongoing commitment to developing innovative technology that supports law firms with secure, efficient and scalable financial management.

meaningful. This recognition reflects the company’s ongoing commitment to developing innovative technology that supports law firms with secure, efficient and scalable financial management.

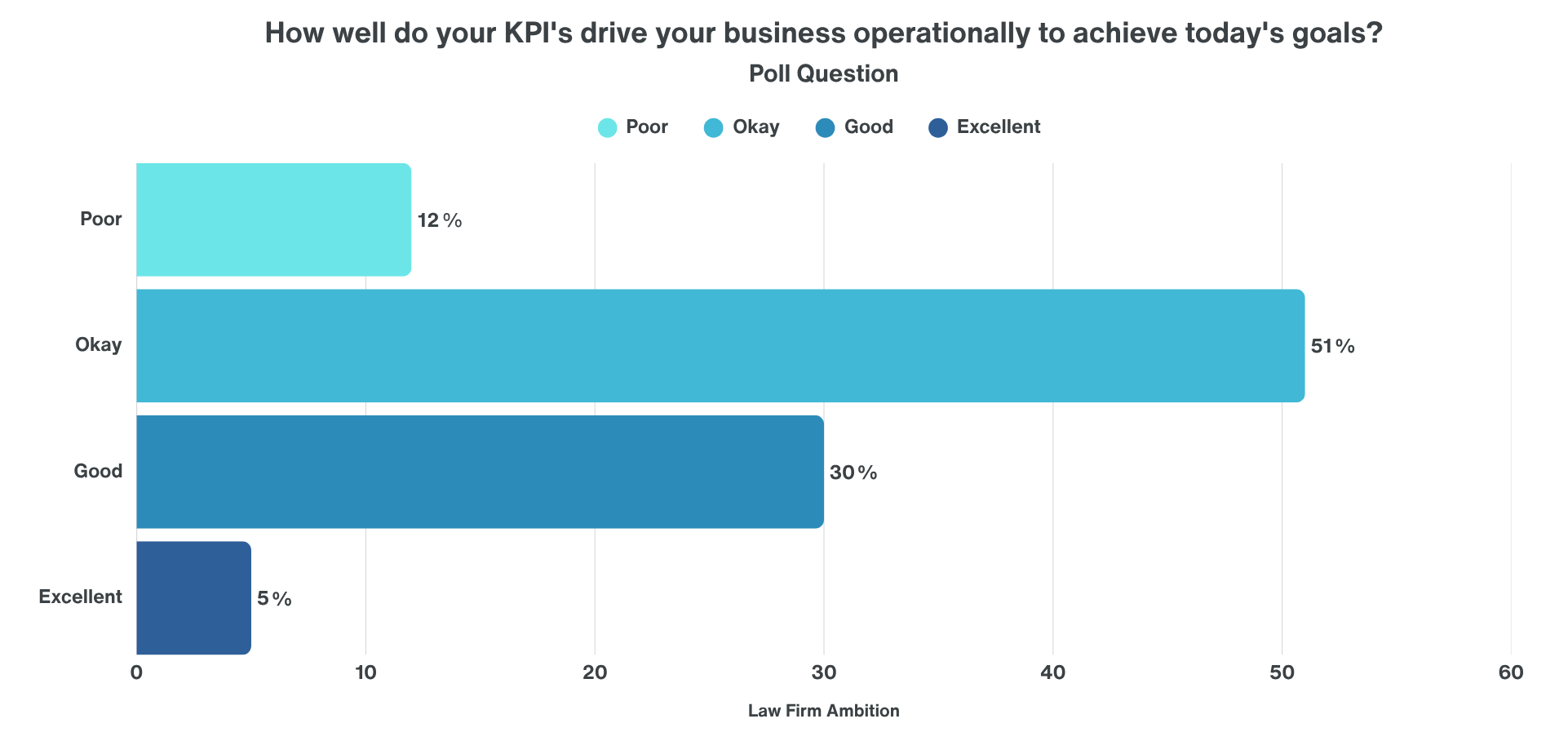

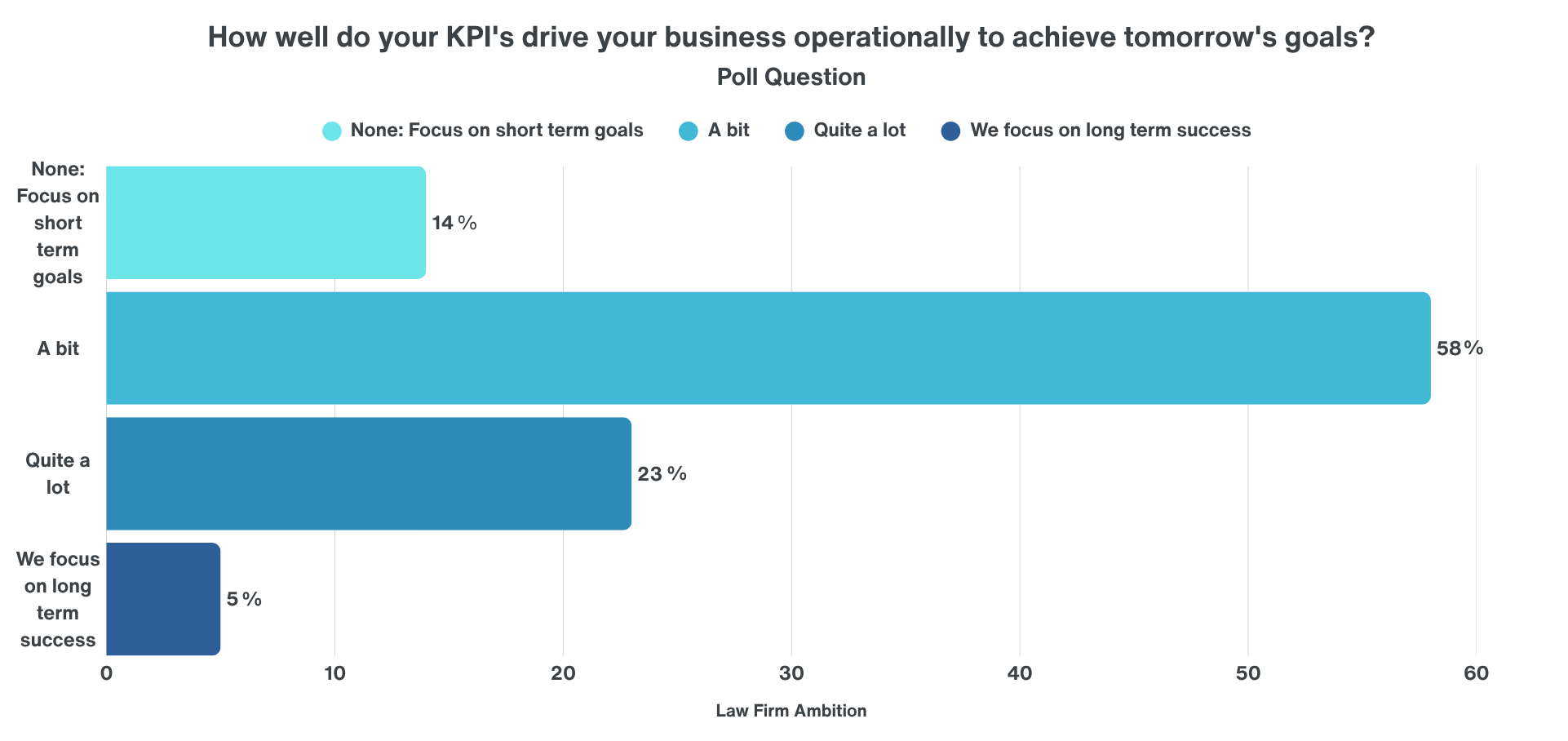

Law firms are becoming more strategic than they were five to ten years ago by using tools like Power BI and Katchr to monitor performance. However, in a poll conducted by

Law firms are becoming more strategic than they were five to ten years ago by using tools like Power BI and Katchr to monitor performance. However, in a poll conducted by Strategically, 14% of respondents focus solely on short-term goals, 58% a bit, 23% quite a lot, and just 5% focus on long-term success. Firms in the first two categories have an opportunity to strengthen their KPI approach by documenting, aligning with strategy, and regularly reviewing them, they can ensure the right conversations are happening across the business.

Strategically, 14% of respondents focus solely on short-term goals, 58% a bit, 23% quite a lot, and just 5% focus on long-term success. Firms in the first two categories have an opportunity to strengthen their KPI approach by documenting, aligning with strategy, and regularly reviewing them, they can ensure the right conversations are happening across the business.

While this transition has improved flexibility and scalability, it’s also exposed gaps in firms’ digital infrastructure, highlighting the need for robust tech stacks and secure remote access.

While this transition has improved flexibility and scalability, it’s also exposed gaps in firms’ digital infrastructure, highlighting the need for robust tech stacks and secure remote access.  Cybersecurity isn’t just about having the right tools. It’s about continuous employee training, secure remote access policies, and building a culture of security awareness across the firm.

Cybersecurity isn’t just about having the right tools. It’s about continuous employee training, secure remote access policies, and building a culture of security awareness across the firm.

Contact Tracey Longbottom today to discover how your firm can benefit from smarter, more efficient compliance processes:

Contact Tracey Longbottom today to discover how your firm can benefit from smarter, more efficient compliance processes: