There is a Caveat

“So I Can’t Get A Grant And I Can’t Administer The Estate”

We increasingly hear from private client practitioners that they cannot obtain a grant of probation because a caveat has been registered, which prevents the Grant from being issued. Often, practitioners don’t even know that a Caveat has been registered until they make an application for a Grant of Representation and find that the application is “stopped” by the Probate Registry. We are often asked to help when this happens.

It is increasingly common to find that Estate Administration is delayed by a Caveat – over 10,000 caveats a year are registered – sometimes it appears to us that Caveats are mischievously registered deliberately to cause havoc in the Administration of an Estate and to try to strengthen the negotiation position of a disappointed beneficiary.

Doing Nothing?

In our view, taking the easy option and doing nothing is inappropriate. Estates are to be administered. Any practitioner who leaves an estate in a state of inertia is potentially risking a claim.

It is all well and good to say that it doesn’t matter if an Estate property is not sold – because property prices typically increase year on year. ANY real property is at risk from flooding or vandalism. We have seen many cases where insurers refuse to pay out when this happens because inspection conditions have not been fulfilled. Company shares can increase or decrease in value equally. Premium Bonds held by a deceased cease to be eligible for prizes after 12 months from death. Seemingly sound financial investments can turn to dust if a company becomes insolvent.

So, What Can Be Done?

There are two primary avenues that can be taken to secure the Administration of the Estate.

Attack The Caveat

It is relatively easy to serve a Warning to a Caveat – to enter an Appearance or to have the Caveat dismissed. It is equally easy for a Caveator to serve an Appearance, making the Caveat permanent. Many practitioners leave things there – on the basis that there is nothing more that they can do without actually starting court proceedings – which is always a last resort and invariably involves the worry, risk, and expense of court proceedings.

If a Caveator simply registers the Caveat and then takes no substantive action to make progress, we have found that the Probate Registry is becoming increasingly amenable to making Orders to get the Caveat dismissed – in the form of a “Put Up or Shut Up” type Order – this is where the Probate Registry will make an Order to say something like – if the Caveator does not start probate validity proceedings within 28 days then the Caveat will be dismissed. Obviously, it would be inappropriate to go straight from the service of an Appearance to a Put Up or Shut Up type application. Careful steps need to be taken to set up the Caveator to make progress – for example to start legal proceedings to challenge the validity of the Will. A Put Up or Shut Up order will often allow the Personal Representative to obtain a “full” Grant of Probate.

A Grant Ad Colligenda Bona

The second route is to make an application for a Grant ad Colligenda Bona. This Grant is often known as a “Limited Grant” or a “Collection Grant”. It allows a Personal Representative to obtain a Grant to call in and collect the assets of the Estate, pay debts – but not distribute the Estate. Such a Grant need not be obtained by a Personal Representative – it could, for example, be obtained by an independent professional. Notice should be given to the Caveator before such an application is made – and if it isn’t, it could lead to a Grant ad Colligenda Bona being set aside. At first sight, an application for a Grant ad Colligenda Bona can be daunting – but at IDR, we are surprised that this process is not used much more frequently than it is. Care needs to be taken with regard to the wording of the Grant – for example, whether it is a general application covering all of the assets of the Estate or whether it is limited to the sale of particular properties or the like.

Stephen is a specialist Contentious Probate Solicitor with an extensive history. He has dealt with all aspects of Contentious Will Trusts & Probate cases, acting for both Claimants and Defendant clients. He is a partner at IDR Law and the current chair of the Law Society Wills Society Wills and Equity Committee. Stephen is also a legal author, having written for numerous publications, including The Times, Law Society Gazette, Family Law Journal, APIL PI Focus, STEP TQR, ACTAPS and numerous other journals.

To watch Stephen discuss this topic with Ian Bond, the former Chair of the Law Society Wills and Equity Committee, please click here.

Stephen is a specialist Contentious Probate Solicitor with an extensive history. He has dealt with all aspects of Contentious Will Trusts & Probate cases, acting for both Claimants and Defendant clients. He is a partner at IDR Law and the current chair of the Law Society Wills Society Wills and Equity Committee. Stephen is also a legal author, having written for numerous publications, including The Times, Law Society Gazette, Family Law Journal, APIL PI Focus, STEP TQR, ACTAPS and numerous other journals.

Stephen is a specialist Contentious Probate Solicitor with an extensive history. He has dealt with all aspects of Contentious Will Trusts & Probate cases, acting for both Claimants and Defendant clients. He is a partner at IDR Law and the current chair of the Law Society Wills Society Wills and Equity Committee. Stephen is also a legal author, having written for numerous publications, including The Times, Law Society Gazette, Family Law Journal, APIL PI Focus, STEP TQR, ACTAPS and numerous other journals.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

Cashroom

Cashroom

Can you tell us how Cashroom is supporting this?

Can you tell us how Cashroom is supporting this?

Catherine O’Day, Founder and Non Exec Director

Catherine O’Day, Founder and Non Exec Director

There was real interest and excitement for the event and on 30th January a group of around 20 of us gathered at

There was real interest and excitement for the event and on 30th January a group of around 20 of us gathered at

change will bring. Defining why this change matters and how it will impact the firm sets a solid foundation. For example, if the change involves new technology for case management, explain how it will streamline client onboarding, improve document access, or enhance workflow efficiency. Engaging stakeholders early in the process—such as senior partners and department heads—ensures that key figures are aligned and supportive from the beginning. They can help communicate the vision consistently, reinforcing it across the firm to build understanding and enthusiasm.

change will bring. Defining why this change matters and how it will impact the firm sets a solid foundation. For example, if the change involves new technology for case management, explain how it will streamline client onboarding, improve document access, or enhance workflow efficiency. Engaging stakeholders early in the process—such as senior partners and department heads—ensures that key figures are aligned and supportive from the beginning. They can help communicate the vision consistently, reinforcing it across the firm to build understanding and enthusiasm.

A great starting point is to take stock of your firm’s financial health. Reviewing your performance from 2024 allows you to understand what went well and where

A great starting point is to take stock of your firm’s financial health. Reviewing your performance from 2024 allows you to understand what went well and where

strengthened the security and accuracy of financial transactions for our clients, reducing fraud risks and ensuring smoother payment workflows for law firms.

strengthened the security and accuracy of financial transactions for our clients, reducing fraud risks and ensuring smoother payment workflows for law firms.

cards, consider tailoring messages to individual clients, acknowledging shared successes or milestones from the past year. Consider gifting clients something thoughtful yet professional. Whether it’s a donation to a charity in their name, a book related to their interests, or a festive treat from a local business, a personal touch reflects your appreciation and can leave a lasting positive impression of your firm.

cards, consider tailoring messages to individual clients, acknowledging shared successes or milestones from the past year. Consider gifting clients something thoughtful yet professional. Whether it’s a donation to a charity in their name, a book related to their interests, or a festive treat from a local business, a personal touch reflects your appreciation and can leave a lasting positive impression of your firm.  bonuses, team recognition awards, or a simple thank-you message from firm leadership, acknowledging the contributions of every member is key to boosting morale. Encouraging your team to take a break from their usual routines by organising a holiday event such as an office party can create a sense of solidarity, helping staff relax and bond in a low-pressure environment.

bonuses, team recognition awards, or a simple thank-you message from firm leadership, acknowledging the contributions of every member is key to boosting morale. Encouraging your team to take a break from their usual routines by organising a holiday event such as an office party can create a sense of solidarity, helping staff relax and bond in a low-pressure environment.

But leading on from that- is the work we win good quality? Is there a risk that we are in a sector that has ever decreasing margin? Or is it a sector where a huge amount of very high quality work can be done, but there may be a long tail before billing can happen. Cashflow risks right there!

But leading on from that- is the work we win good quality? Is there a risk that we are in a sector that has ever decreasing margin? Or is it a sector where a huge amount of very high quality work can be done, but there may be a long tail before billing can happen. Cashflow risks right there!

reassurance, and peace of mind. Whether it’s helping a family buy their first home, advising a business through a complex contract, or representing someone in court, your role as a trusted advisor is irreplaceable.

reassurance, and peace of mind. Whether it’s helping a family buy their first home, advising a business through a complex contract, or representing someone in court, your role as a trusted advisor is irreplaceable. Show empathy by acknowledging their concerns and providing clear, compassionate advice. In doing so, you’ll build a stronger bond with your clients and help ease their anxiety.

Show empathy by acknowledging their concerns and providing clear, compassionate advice. In doing so, you’ll build a stronger bond with your clients and help ease their anxiety.

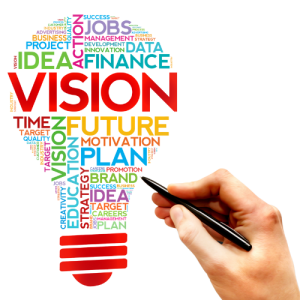

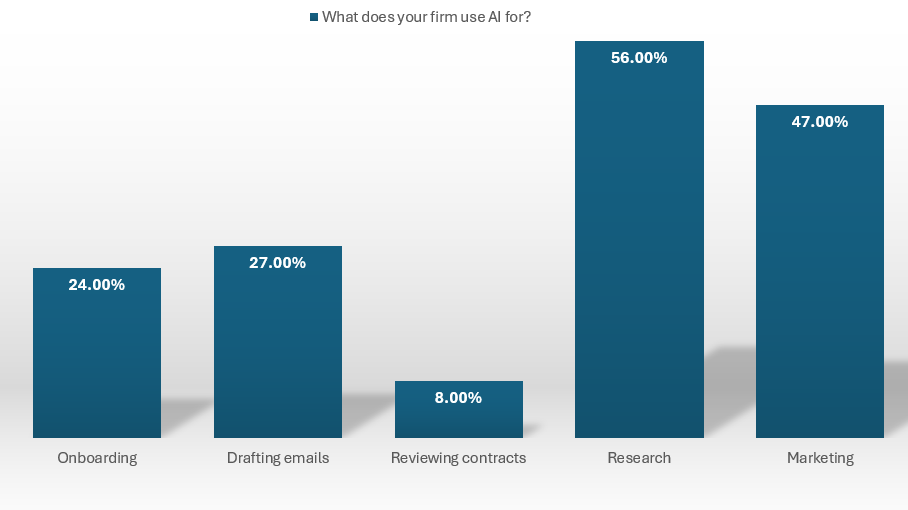

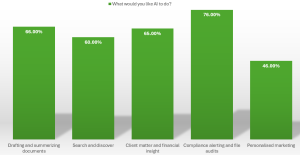

When Law Firm Ambition asked what firms would like AI to handle, 76% of respondents indicated compliance alerting and file audits, 66% wanted drafting and summarising documents, and 65% sought client matter and financial insights. As AI technology advances, it will likely expand its capabilities across these areas, becoming an indispensable tool for modern law practice.

When Law Firm Ambition asked what firms would like AI to handle, 76% of respondents indicated compliance alerting and file audits, 66% wanted drafting and summarising documents, and 65% sought client matter and financial insights. As AI technology advances, it will likely expand its capabilities across these areas, becoming an indispensable tool for modern law practice.

ensure compliance processes are followed with precision and accuracy, ensuring that all processes align with your regulatory requirements. Our technology allows for real-time monitoring and reporting, providing law firms with full visibility over their financial operations.

ensure compliance processes are followed with precision and accuracy, ensuring that all processes align with your regulatory requirements. Our technology allows for real-time monitoring and reporting, providing law firms with full visibility over their financial operations.

and reconcile your accounts from the previous year. This process can be time-consuming, and the more disorganised your books are, the longer it will take to get them in a healthy state. By acting early, you can avoid this backlog and ensure your books are ready for the new year from day one.

and reconcile your accounts from the previous year. This process can be time-consuming, and the more disorganised your books are, the longer it will take to get them in a healthy state. By acting early, you can avoid this backlog and ensure your books are ready for the new year from day one. The best way to ensure a smooth start to the new year is to sign your outsourcing contract as early as possible. This gives your new bookkeeping partner time to assess your firm’s financial situation and start cleaning up your accounts before January. It also gives your team time to adjust to the new system and processes, ensuring that everything is in order and that work can begin immediately in the new year. Cashroom offer a full onboarding service and training for your staff, so they are confident with our portal, to minimize disruption and ensure a smooth transition from the start.

The best way to ensure a smooth start to the new year is to sign your outsourcing contract as early as possible. This gives your new bookkeeping partner time to assess your firm’s financial situation and start cleaning up your accounts before January. It also gives your team time to adjust to the new system and processes, ensuring that everything is in order and that work can begin immediately in the new year. Cashroom offer a full onboarding service and training for your staff, so they are confident with our portal, to minimize disruption and ensure a smooth transition from the start.