Switching Your Practice Case Management System: A Necessary Disruption?

Guest blogger: Stephen Brown

For many law firms, the Practice and Case Management System (PCMS) sits quietly at the centre of everything. It underpins billing, matter management, compliance, reporting and day-to-day workflows. Which is precisely why the idea of changing it can feel so daunting.

Even firms that know their system is creaking often put off the decision. The reasons are understandable: cost, disruption, fear of getting it wrong, and a very real concern about how change will land with partners, lawyers and support teams who are already stretched. A PCMS overhaul touches the entire firm, and there are few “low risk” ways to approach it.

Yet the risk of not changing can be greater.

Stephen Brown, Director of Lights-On Consulting, a specialist legal IT consultancy, says: “Legacy systems that once served firms well can quietly become a brake on growth. Workarounds multiply. Processes become clunky. Reporting takes longer than it should and you question the integrity of the data the information is based on. Integration with newer tools becomes harder, if not impossible. Over time, firms find themselves adapting their ways of working to suit the system – rather than the system supporting the firm”

So how do you know when it’s time to make the move?

Signs Your PCMS Is Holding You Back

There is rarely a single trigger. More often, it’s an accumulation of frustrations that start to affect performance and confidence. Common signs include:

- Increasing reliance on workarounds to handle billing, reporting or compliance

- Poor integration with other systems, or your legacy system requires technology which adds complications to working in a modern way

- User dissatisfaction, particularly among newer lawyers who expect modern, intuitive tools

- Inflexibility when adapting to new practice areas, higher volumes or different fee models

- Vendor support tapering off, costs increasing, or the product roadmap no longer aligning with your direction

Individually, these issues can be tolerated. Together, they usually signal that the system is no longer fit for purpose.

Why Firms Delay – and Why That’s Human

It’s worth acknowledging why so many firms stay put longer than they should. A PCMS change is expensive, visible and disruptive. It demands time from busy people. It carries reputational risk internally if it goes wrong.

There is also a cultural dimension. Law firms value stability. Many partners have lived through multiple waves of technology change and are understandably sceptical about “the next big thing”. Others worry about how change will affect their own ways of working.

Recognising these realities isn’t a weakness. It’s the starting point for managing change properly.

Preparing Well: What to Think About Early

Successful PCMS programmes are won or lost long before contracts are signed. Firms that invest time upfront consistently fare better. Key considerations include:

- Assess real needs, not just frustrations

Start with how the firm actually works today – and how it needs to work in three to five years. Growth plans, mergers, new service lines and pricing models should all inform requirements. - Be realistic about budget and resource

The licence cost is only part of the picture. Internal time, data migration, training and post-go-live support all need to be factored in. Underestimating this is one of the most common pitfalls. - Set clear priorities

Not everything has to be solved on day one. Decide what is mission-critical for go-live and what can sensibly follow once the firm has stabilised. - Run a disciplined procurement process

Demos alone are not enough. Structured evaluation against actual requirements, reference checks and scenario testing help cut through polished sales messages to what will actually work in practice. New systems are architecturally modern; however, some of them lack the maturity of legacy products. - Pilot properly

Piloting with the right mix of users – not just the most tech-enthusiastic – surfaces issues early and builds credibility across the firm. - Choose a sensible implementation timeline

Too fast creates risk. Too slow drains momentum. The right pace balances business-as-usual pressures with the need for focus and accountability.

Change Management Is the Difference

The firms that get the most value from a new PCMS treat it as a business change programme, not an IT project. They communicate early and honestly. They involve influential partners and respected users. They invest in training that reflects real workflows, not generic functionality.

This is where experienced, independent guidance can be invaluable. Consultants who have sat on both sides of the table – inside law firm IT teams and advising firms through complex change – bring a level of pragmatism that templates and vendor assurances cannot.

At Lights-On Consulting, our team has collectively managed hundreds of PCMS overhauls for large international firms, SMEs and boutiques alike. We have got the scars so our clients can avoid them . Our role is not to “sell a system”, but to help firms make confident decisions, prepare thoroughly and carry their people with them through the transition.

The Bigger Picture

Switching your PCMS is never just about software. It’s about ensuring the firm’s core systems can support its strategy, its people, and its clients now and in the future.

Putting off the decision may feel safer in the short term. But firms that address it thoughtfully, with clear intent and the right support, often find the outcome is not just a better system, but a more resilient, future-ready business.

If nothing else, it’s worth asking the question: is our PCMS quietly limiting what we could become?

About the Author

Stephen Brown is an IT Consultant at Lights-On Consulting, specialising in helping legal and professional services firms solve complex IT and leadership challenges. With a background in senior IT roles, including IT Director within a regional law firm, Stephen brings a practical, inside-the-business perspective to IT strategy, procurement and delivery. He advises a wide range of firms on strategic IT reviews, leadership, major programmes and supplier selection. He is a regular speaker at industry events, law firm partner away days and is a frequent contributor to the legal technology press.

Interested in a confidential chat?

If you are considering outsourcing your legal cashiering, or just want to find out how it works, our team is here to help.

Cashroom provides expert outsourced account services for law firms including legal cashiering, management accounts and payroll services. Our mission is to fee lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

“I’ve been a client of Cashroom for over 10 years and couldn’t fault the service. When I started the firm, I had basic knowledge of compliance and bookkeeping but didn’t feel confident managing it myself. Cashroom took that weight off my shoulders and provided an invaluable resource I wouldn’t have been able to afford in-house.”

Alex Holt, Chief Revenue Officer at The Cashroom, has over 30 years’ experience in the legal sector, including as a law firm partner. He brings deep expertise in law firm operations, financial management, and strategic growth, helping firms optimise processes, improve efficiency, and navigate change while delivering exceptional client service.

Alex Holt, Chief Revenue Officer at The Cashroom, has over 30 years’ experience in the legal sector, including as a law firm partner. He brings deep expertise in law firm operations, financial management, and strategic growth, helping firms optimise processes, improve efficiency, and navigate change while delivering exceptional client service.

“When we first started developing the Portal, our focus was on creating a platform that would simplify legal finance for firms, reduce the need for email communications, while keeping client money secure. Over the years, our team has grown alongside the platform, expanding our expertise, refining workflows, integrating with multiple systems and continuously responding to the real challenges our clients face. Seeing the Portal evolve from a simple solution into a sophisticated, integrated platform has been incredibly rewarding.”

“When we first started developing the Portal, our focus was on creating a platform that would simplify legal finance for firms, reduce the need for email communications, while keeping client money secure. Over the years, our team has grown alongside the platform, expanding our expertise, refining workflows, integrating with multiple systems and continuously responding to the real challenges our clients face. Seeing the Portal evolve from a simple solution into a sophisticated, integrated platform has been incredibly rewarding.”

meaningful. This recognition reflects the company’s ongoing commitment to developing innovative technology that supports law firms with secure, efficient and scalable financial management.

meaningful. This recognition reflects the company’s ongoing commitment to developing innovative technology that supports law firms with secure, efficient and scalable financial management.

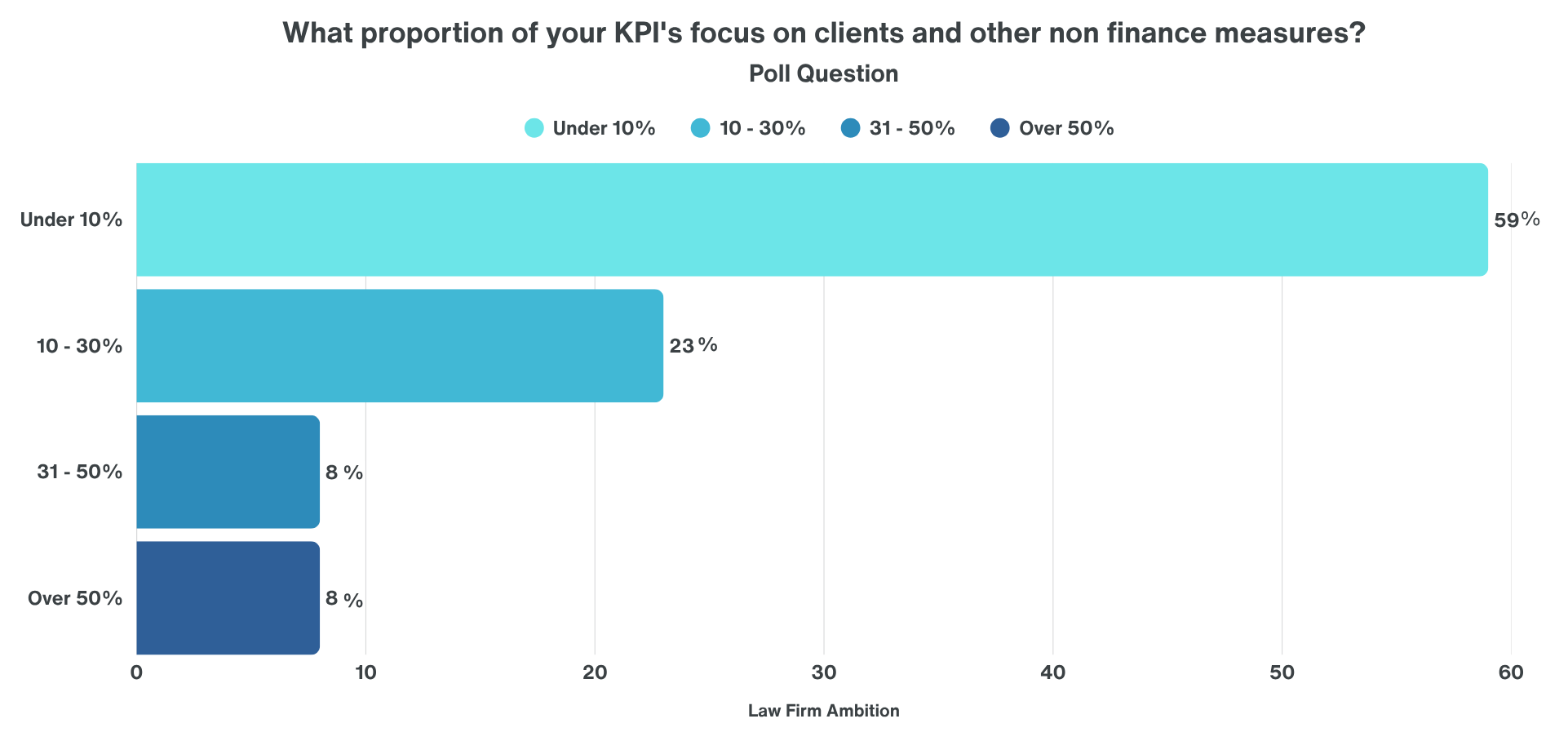

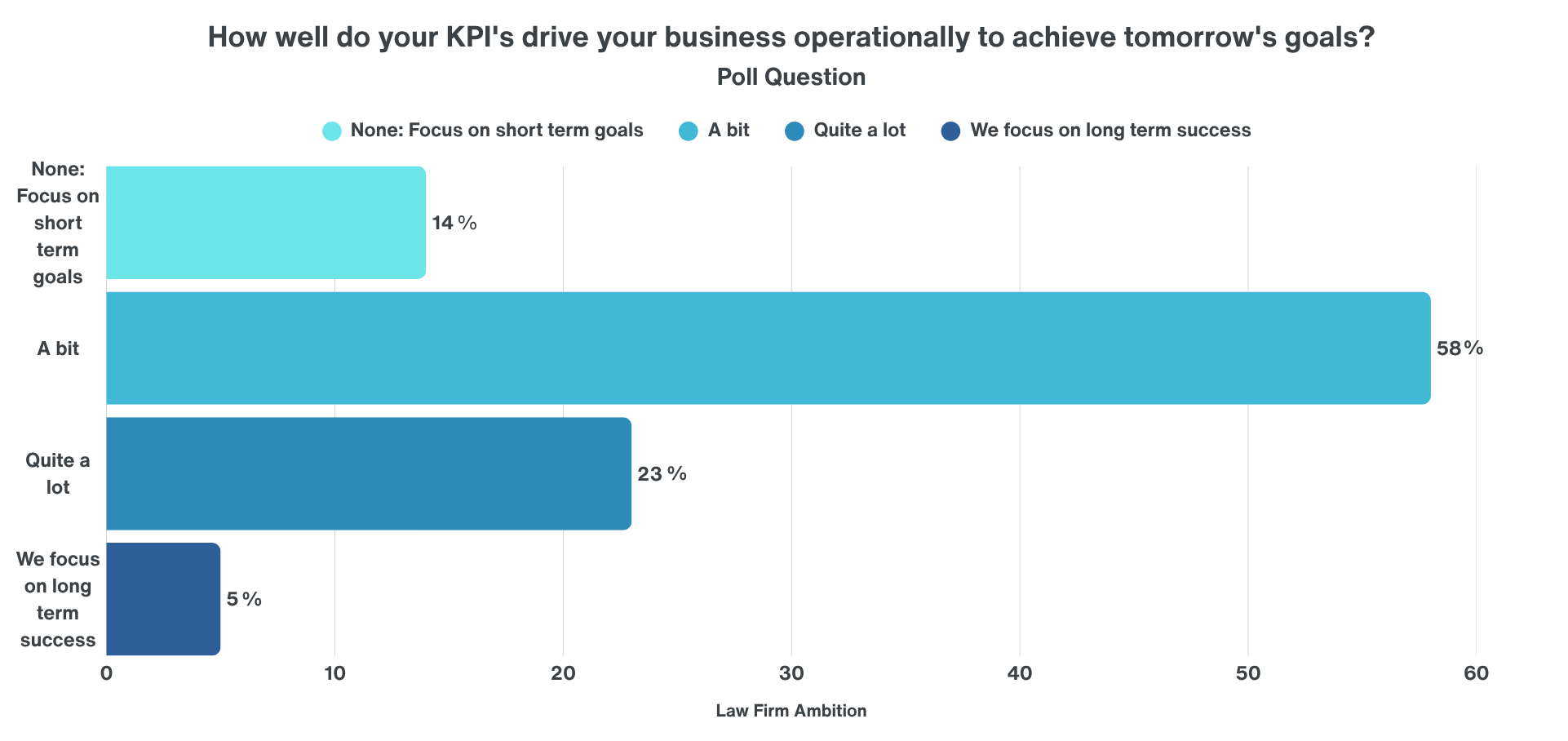

Law firms are becoming more strategic than they were five to ten years ago by using tools like Power BI and Katchr to monitor performance. However, in a poll conducted by

Law firms are becoming more strategic than they were five to ten years ago by using tools like Power BI and Katchr to monitor performance. However, in a poll conducted by Strategically, 14% of respondents focus solely on short-term goals, 58% a bit, 23% quite a lot, and just 5% focus on long-term success. Firms in the first two categories have an opportunity to strengthen their KPI approach by documenting, aligning with strategy, and regularly reviewing them, they can ensure the right conversations are happening across the business.

Strategically, 14% of respondents focus solely on short-term goals, 58% a bit, 23% quite a lot, and just 5% focus on long-term success. Firms in the first two categories have an opportunity to strengthen their KPI approach by documenting, aligning with strategy, and regularly reviewing them, they can ensure the right conversations are happening across the business.