England and Wales new SRA Accounting Rules

As we suspect you are aware, new SRA Accounting Rules will be effective from 25th November 2019. These come with some significant changes to the current rules and with the added responsibility of understanding what the rules mean to you as a firm.

We have prepared guidance notes and pro forma policy documents which can be used or tweaked for your own firm. We believe these will be extremely useful for all of our current clients and indeed non clients as they will enable compliance with these new regulations, and provide advice on the impact they may have on your current procedures.

These documents are available at a one-off charge of £200 plus VAT for all existing clients of The Cashroom, and £300 plus VAT for all non Cashroom clients. For more information please contact chloe.mcginn@thecashroom.co.uk.

Commissioner’s Office (

Commissioner’s Office ( Perhaps some sound advice would be to pause for breath the next time a client asks your professional view on something outside your area of expertise. Is there a colleague who may be better placed to advise? Is there another friendly firm who would look after your client for this particular matter, but not poach them for future work? Perhaps you are part of a network such as the

Perhaps some sound advice would be to pause for breath the next time a client asks your professional view on something outside your area of expertise. Is there a colleague who may be better placed to advise? Is there another friendly firm who would look after your client for this particular matter, but not poach them for future work? Perhaps you are part of a network such as the  knowledge, it could potentially be dangerous for a number of reasons. For example, are you up to speed with the latest cyber fraud tactics? Are you fully aware of what your employees’ rights and responsibilities are from an HR perspective? Or is trying to do your own cashiering going to land you in hot water at a compliance inspection/audit. With all of these examples, you may ‘think’ you know what you are doing, or that you can get by, but do you “know’ what you are doing? If not, the additional time you’re spending on them, not to mention the stress, probably more than justifies delegating to somebody better placed to deal with them, or outsourcing those responsibilities to experienced experts or third-party providers. That way, you can sleep at night knowing things are being done properly, that you are covered from an insurance point of you, and just as importantly, that you can focus on what you do best, whether that be generating new business for your firm, or doing fee earning work for clients. I hope there is some food for thought here, and some take away points to discuss at your next Partners meeting.

knowledge, it could potentially be dangerous for a number of reasons. For example, are you up to speed with the latest cyber fraud tactics? Are you fully aware of what your employees’ rights and responsibilities are from an HR perspective? Or is trying to do your own cashiering going to land you in hot water at a compliance inspection/audit. With all of these examples, you may ‘think’ you know what you are doing, or that you can get by, but do you “know’ what you are doing? If not, the additional time you’re spending on them, not to mention the stress, probably more than justifies delegating to somebody better placed to deal with them, or outsourcing those responsibilities to experienced experts or third-party providers. That way, you can sleep at night knowing things are being done properly, that you are covered from an insurance point of you, and just as importantly, that you can focus on what you do best, whether that be generating new business for your firm, or doing fee earning work for clients. I hope there is some food for thought here, and some take away points to discuss at your next Partners meeting.

After all, change can bring risk, so you need to be confident that the strategy you implement will be worth it. Speaking to third party experts about outsourcing your account services should reassure you that the impact will be beneficial on your business moving forward.

After all, change can bring risk, so you need to be confident that the strategy you implement will be worth it. Speaking to third party experts about outsourcing your account services should reassure you that the impact will be beneficial on your business moving forward. There are catastrophic implications of not defending against data breaches and cybercrime. But, before you can put stringent security processes in place, you have to understand the risks.

There are catastrophic implications of not defending against data breaches and cybercrime. But, before you can put stringent security processes in place, you have to understand the risks. Property hijackings (where criminals pose as owners) are escalating. In many cases, criminals will rent a property and steal the landlord’s post. They then use this to pose as the real owner and sell the house to cash buyers.

Property hijackings (where criminals pose as owners) are escalating. In many cases, criminals will rent a property and steal the landlord’s post. They then use this to pose as the real owner and sell the house to cash buyers. Malware attacks – where malicious software is installed on a user’s machine – can be extremely damaging; to your day-to-day operations, your reputation, and your bottom line. Ransomware attacks – an aggressive form of malware which prevents access to systems unless a payment is made – can be even worse.

Malware attacks – where malicious software is installed on a user’s machine – can be extremely damaging; to your day-to-day operations, your reputation, and your bottom line. Ransomware attacks – an aggressive form of malware which prevents access to systems unless a payment is made – can be even worse. Information security certification (e.g. ISO 27001 or Cyber Essentials) helps to protect client and employee data. This won’t just keep sensitive data secure, it will also demonstrate to clients (and the ICO) that you take your responsibilities seriously.

Information security certification (e.g. ISO 27001 or Cyber Essentials) helps to protect client and employee data. This won’t just keep sensitive data secure, it will also demonstrate to clients (and the ICO) that you take your responsibilities seriously. At

At  Outsourcing to The Cashroom has been painless. So easy to deal with accommodating everything that we need to do, when we need to do it, whilst keeping us on the right side of the vast array of regulations.

Outsourcing to The Cashroom has been painless. So easy to deal with accommodating everything that we need to do, when we need to do it, whilst keeping us on the right side of the vast array of regulations.  At the same time, the total cost of employing in-house cashiering personnel is expensive. Because, in addition to wages, you also have to take the costs of recruitment, induction, training, mentoring, sick pay, maternity cover, holiday cover, pension contributions, and National Insurance into consideration.

At the same time, the total cost of employing in-house cashiering personnel is expensive. Because, in addition to wages, you also have to take the costs of recruitment, induction, training, mentoring, sick pay, maternity cover, holiday cover, pension contributions, and National Insurance into consideration. The Cashroom offer an invaluable service for any solicitor’s firm. Their approach is efficient, professional and responsive. They have allowed us to deal with rapid growth by taking on all accounts functionality.”

The Cashroom offer an invaluable service for any solicitor’s firm. Their approach is efficient, professional and responsive. They have allowed us to deal with rapid growth by taking on all accounts functionality.” The Cashroom has definitely been a good business move, not only because of efficiency but also in relation to compliance which can be daunting at times.”

The Cashroom has definitely been a good business move, not only because of efficiency but also in relation to compliance which can be daunting at times.” We operate a business which requires efficiency and certainty of service. The Cashroom has augmented our own internal accounts team, taking control of key elements and working closely to provide a seamless service to us.

We operate a business which requires efficiency and certainty of service. The Cashroom has augmented our own internal accounts team, taking control of key elements and working closely to provide a seamless service to us.  How quickly can you get up and running?

How quickly can you get up and running? We have been using The Cashroom’s services for three years now. We brought them in to provide a secure, efficient, compliant cashiering function to support our growing business with their flexible resource model.

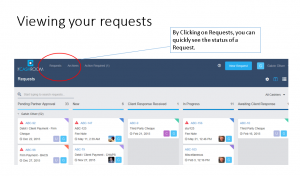

We have been using The Cashroom’s services for three years now. We brought them in to provide a secure, efficient, compliant cashiering function to support our growing business with their flexible resource model.  We do not have a ‘system’ or software that we use, we simply access the accounts part of your existing Practice Management System remotely. So, all you need is a legal practice management system of some sort, and a means of us accessing it remotely. We also have a secure client portal which all of our clients are on, creating a secure environment for both The Cashroom and client to communicate without the cyber risks of email. This also avoids having to protect sensitive data via email. Training can also be given to ensure you are comfortable when using the portal.

We do not have a ‘system’ or software that we use, we simply access the accounts part of your existing Practice Management System remotely. So, all you need is a legal practice management system of some sort, and a means of us accessing it remotely. We also have a secure client portal which all of our clients are on, creating a secure environment for both The Cashroom and client to communicate without the cyber risks of email. This also avoids having to protect sensitive data via email. Training can also be given to ensure you are comfortable when using the portal. We allocate each client to a cashiering team, headed up by a very experienced senior cashier, essentially your ‘Head Cashier’. They will have a small team of people who will work with your firm, in order that holidays, sickness cover etc, are not a problem for you. You will get to know the two or three people working with your firm very quickly, and build a relationship with them. You can pick up the phone or send a query via our secure client portal to these selected people at any point and be ensured that someone will always be about to help.

We allocate each client to a cashiering team, headed up by a very experienced senior cashier, essentially your ‘Head Cashier’. They will have a small team of people who will work with your firm, in order that holidays, sickness cover etc, are not a problem for you. You will get to know the two or three people working with your firm very quickly, and build a relationship with them. You can pick up the phone or send a query via our secure client portal to these selected people at any point and be ensured that someone will always be about to help. change makes the difference between whether you sink or swim. One way that savvy firms are choosing to adapt is by outsourcing essential business tasks, like legal cashiering.

change makes the difference between whether you sink or swim. One way that savvy firms are choosing to adapt is by outsourcing essential business tasks, like legal cashiering. Maximise your resource: Benefit from a cost based on the actual activity and skill level your firm requires, rather than having to fund sufficient senior cashiering resource to deal with complex, high-risk elements, while using that same resource to carry out the more mundane, junior tasks.

Maximise your resource: Benefit from a cost based on the actual activity and skill level your firm requires, rather than having to fund sufficient senior cashiering resource to deal with complex, high-risk elements, while using that same resource to carry out the more mundane, junior tasks.  legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly. CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea.

CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea.