Important Banking Update: Purpose Codes Now Mandatory in CHAPS property transactions

Property Codes Now Available in Cashroom Portal

As part of the ongoing enhancements to CHAPS payments to bring system in line with ISO 20022 enhanced data is becoming mandatory. To support this change, property codes are now accessible directly via the Cashroom Portal.

This important regulatory change comes into effect on 1st May 2025. From this date, all property-related CHAPS payments must include the relevant Purpose Code in the structured remittance data.

The Bank of England is adopting new requirements under the ISO 20022 messaging standard. A key change is the mandatory inclusion of Purpose Codes for CHAPS payments relating to property transactions.

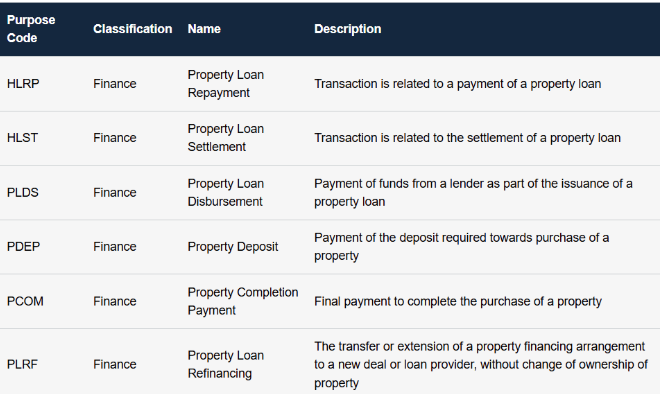

These codes help clearly define the nature of the transaction, supporting improved data quality, enhanced analytics, and better regulatory oversight.

What This Means for Cashroom Users

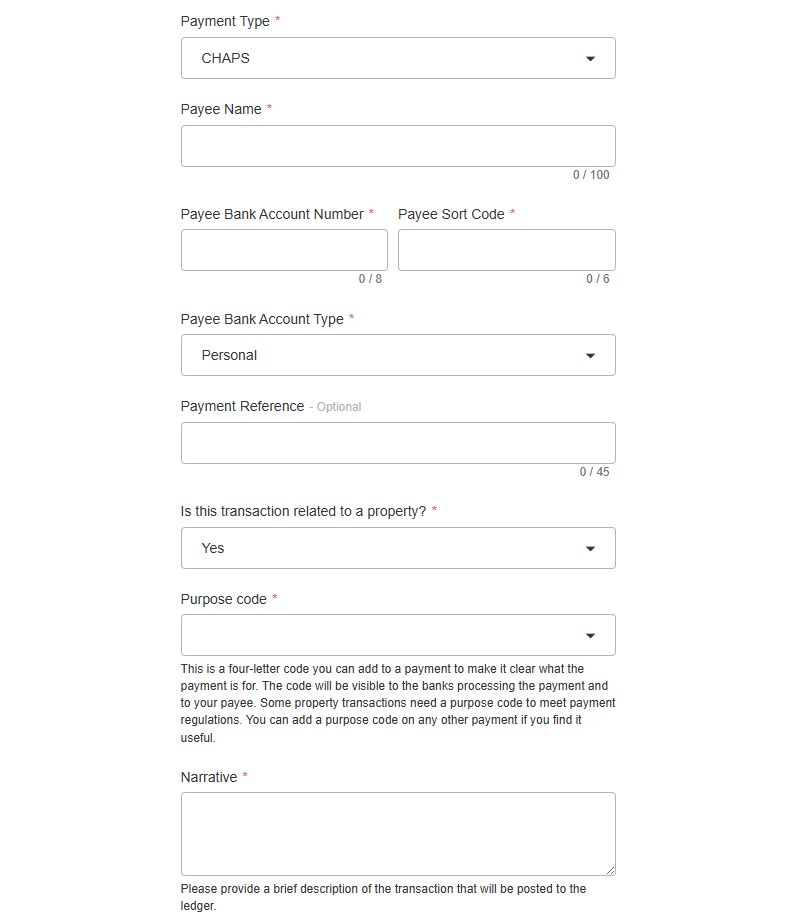

To ensure compliance and make the process as seamless as possible, Cashroom has integrated the mandated ISO 20022 property codes directly into the portal. When making a CHAPS payment that is property-related, users must now select the relevant purpose code from a dropdown menu, ensuring the payment contains the required enhanced data.

When opening a new client payment request in the Cashroom portal, users will now see an additional question asking if the payment is related to a property transaction. If so selecting the appropriate property code from this list is mandatory. This ensures compliance with the new ISO 20022 enhanced data requirements effective from 1st May 2025.

It’s important to note that while Purpose Codes can be added to any CHAPS payment, they are only mandatory for property-related transactions. Payments not classified under property categories do not have a mandatory requirement, but the option to include a Purpose Code is still available.

Key Benefits of This Update

- Compliance made easy: Users can select the correct property code without needing to manually enter or look up codes.

- Future-ready: Aligns with the industry shift towards structured and enriched payment messaging.

- Streamlined workflow: Integrated into the existing CHAPS payment flow within the Cashroom portal for minimal disruption.

For more detailed information on the ISO 20022 requirements for CHAPS and the list of valid property codes, please refer to the Bank of England’s official guidance here.

Cashroom remains committed to keeping clients ahead of regulatory changes and continues to support legal and financial professionals with smart, compliant, and user-friendly solutions.

If you have any questions or would like support navigating this change, Cashroom clients are encouraged to contact their usual Cashroom point of contact for more information and assistance.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.