Ghosted By A Prospect

As Halloween approaches, tales of hauntings and supernatural encounters take centre stage. But if you work in the legal industry, you may have experienced a different kind of chilling story—being ghosted by a prospect. No, we’re not talking about spirits lurking in the halls of your office. We’re talking about that cold, silent disappearance of a promising client prospect. One moment, they’re actively engaging, asking all the right questions, expressing interest in your legal services. The next? They’re gone without a trace.

The Tale of the Vanishing Prospect

You’ve probably been there. You get an email, a phone call, or maybe a referral that feels promising. The prospect seems interested, perhaps even eager to move forward with your legal expertise. Maybe it’s a potential corporate client with a juicy case or a high-net-worth individual looking for good quality estate planning services. You put in the time—sending proposals, answering questions, setting up meetings. It all looks like it’s going to pay off.

You’ve probably been there. You get an email, a phone call, or maybe a referral that feels promising. The prospect seems interested, perhaps even eager to move forward with your legal expertise. Maybe it’s a potential corporate client with a juicy case or a high-net-worth individual looking for good quality estate planning services. You put in the time—sending proposals, answering questions, setting up meetings. It all looks like it’s going to pay off.

Then, suddenly—nothing.

No more emails. No returned calls. Radio silence. It’s as if they’ve fallen off the face of the earth, leaving you with an eerie feeling that something, somewhere, went terribly wrong. What makes it worse is that prospects in the legal field are rarely quick leads to close. They often require significant nurturing. When they disappear after you’ve invested time and effort, it can feel like being ghosted by a spirit in the night.

But why does this happen?

The Anatomy of a Ghosting

There are a variety of reasons why prospects might ghost you in the legal industry:

- Decision Paralysis: Legal decisions carry weight, often involving significant time, money, and risk. Prospects may become overwhelmed by the enormity of choosing the right legal representation, leading them to avoid the decision altogether.

- Better Offers: The legal field is competitive. Prospects might shop around for better deals or more specialised services, only to vanish once they’ve found a different lawyer or firm that meets their needs more closely.

- Financial Hesitation: Sometimes, the cost of legal services becomes a point of contention. Prospects may not feel comfortable discussing their concerns upfront and, instead of negotiating, they opt for the easier route—disappearing.

- Internal Changes: For corporate clients especially, things can shift behind the scenes. The key decision-maker may have left the company, or the urgency of their legal issue may have changed.

- Fear of Confrontation: People generally don’t like saying “no” or delivering bad news. Some prospects may find it easier to disappear than to tell you they’ve chosen another path.

How to Keep Prospects from Vanishing Into Thin Air

Ghosting can be frustrating, but there are ways to reduce the chances of it happening. Here’s how to keep your prospects grounded before they float away:

- Set Clear Expectations from the Start

In the legal industry, clarity is key. Early on, communicate what the next steps will look like, the expected timeline, and what’s required from both sides. When prospects know what to expect, they’re less likely to go dark.

Ask pointed questions like: “When do you hope to make a decision on this matter?” or “Is there a time frame you’re looking to have this case resolved?” This can help you gauge their commitment and avoid unexpected disappearances.

- Create a Follow-Up Strategy

The legal industry thrives on relationships, and following up is crucial. If a prospect doesn’t respond, give them some space—but don’t hesitate to follow up in a way that feels natural. Instead of the generic “Just checking in” email, offer something of value, such as a new insight about their legal challenge, industry news, or even an invite to a relevant event.

The legal industry thrives on relationships, and following up is crucial. If a prospect doesn’t respond, give them some space—but don’t hesitate to follow up in a way that feels natural. Instead of the generic “Just checking in” email, offer something of value, such as a new insight about their legal challenge, industry news, or even an invite to a relevant event.

Using language like, “I just wanted to ensure you had all the information you need to make your decision” can re-engage prospects without feeling pushy.

- Address Hesitations Early

Many prospects may ghost you because they feel uncertain about moving forward. Ask questions early in your interactions to uncover any potential roadblocks. Whether it’s about budget concerns, case complexity, or decision-making authority, addressing these hesitations head-on can help them feel more comfortable.

For example, you might ask, “Are there any concerns about cost, timing, or anything else that we haven’t yet discussed?”

- Provide Social Proof

Ghosting can happen because prospects lose confidence in their decision to move forward with your firm. Bolster their confidence with testimonials, case studies, or industry-specific examples of success. Showing them how you’ve helped similar clients can calm any fears that they might be making the wrong decision.

- Don’t Take It Personally

It’s important to remember that ghosting often has more to do with the prospect’s internal struggles than your legal services. People ghost for all kinds of reasons that may have little to do with you. Don’t let one ghost story haunt you—keep your pipeline filled with other potential clients, so one vanishing act doesn’t throw you off your game.

The Resurrection: What to Do After Being Ghosted

If you’ve already been ghosted, don’t fret—there are ways to resurrect the conversation.

don’t fret—there are ways to resurrect the conversation.

First, give the prospect some time. Then, try sending a light, non-intrusive email that reopens the door without pressure. Something like, “I haven’t heard from you in a while, and I just wanted to make sure everything is okay. Is there anything I can assist you with?”

If that doesn’t work, sometimes letting go is the best course of action. Send a final message to gracefully close the loop, leaving the door open for future contact. “It seems like now might not be the right time. Feel free to reach out if things change, and we’d be happy to assist.”

Conclusion

Getting ghosted by a prospect can feel like a real-life horror story, especially in the legal industry where trust, time, and significant resources are at stake. But like any good mystery, the key to solving the case is understanding why it happened and taking steps to ensure it doesn’t happen again. This Halloween, don’t let ghosting haunt your practice—be proactive, stay connected, and always keep a light on for potential clients that might be wandering back your way.

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

financial insights. The integration of this technology into your practice ensures that all financial data is accurate, up-to-date, and easily accessible when needed. Whether you’re operating on a cobweb covered old PMS or a more modern cutting-edge software, at Cashroom our system agnostic approach means we can help and provide true expertise.

financial insights. The integration of this technology into your practice ensures that all financial data is accurate, up-to-date, and easily accessible when needed. Whether you’re operating on a cobweb covered old PMS or a more modern cutting-edge software, at Cashroom our system agnostic approach means we can help and provide true expertise.  In the spirit of Halloween, it’s easy to see poor accounting as a monster waiting to sabotage your law firm’s success. But just as every haunted house has an escape route, your firm can avoid these terrifying pitfalls by partnering with an expert service provider like Cashroom. With benefits ranging from cost savings to compliance security, outsourcing legal accounting allows your firm to focus on what matters most – serving your clients and growing your practice.

In the spirit of Halloween, it’s easy to see poor accounting as a monster waiting to sabotage your law firm’s success. But just as every haunted house has an escape route, your firm can avoid these terrifying pitfalls by partnering with an expert service provider like Cashroom. With benefits ranging from cost savings to compliance security, outsourcing legal accounting allows your firm to focus on what matters most – serving your clients and growing your practice.

biggest pain point is often

biggest pain point is often

next webinar in November “Current AI and Automation in Law Firms”

next webinar in November “Current AI and Automation in Law Firms”

Mindfulness is a practice that helps you focus on the present moment and reduce stress. Whether through meditation, breathing exercises, or simply taking a few moments to be still, mindfulness can help you stay grounded and improve your emotional resilience.

Mindfulness is a practice that helps you focus on the present moment and reduce stress. Whether through meditation, breathing exercises, or simply taking a few moments to be still, mindfulness can help you stay grounded and improve your emotional resilience.

Happy clients can be helpful in strategic ways – case studies and testimonials on collateral and on websites can be very powerful. Even more valuable are those wonderful clients who will take reference calls with prospective clients- often forming a clinching element as they expound the benefits of what we do to a buyer who sees that endorsement as a final factor before signing.

Happy clients can be helpful in strategic ways – case studies and testimonials on collateral and on websites can be very powerful. Even more valuable are those wonderful clients who will take reference calls with prospective clients- often forming a clinching element as they expound the benefits of what we do to a buyer who sees that endorsement as a final factor before signing. forget our own staff- happy clients create happy staff, and vice versa. Working for people who like what we do is a much more pleasant experience. Not to mention the fact that happy clients stay with you- in our case for many years. Client retention is one of the best indicators of client satisfaction.

forget our own staff- happy clients create happy staff, and vice versa. Working for people who like what we do is a much more pleasant experience. Not to mention the fact that happy clients stay with you- in our case for many years. Client retention is one of the best indicators of client satisfaction.

Cashroom is the UK’s premier choice for outsourced legal

Cashroom is the UK’s premier choice for outsourced legal

Mismanagement of client funds can lead to severe penalties, including fines, suspension, or even disbarment. The hidden cost here lies in the

Mismanagement of client funds can lead to severe penalties, including fines, suspension, or even disbarment. The hidden cost here lies in the  Errors in legal accounting, especially in handling client funds, can damage a firm’s

Errors in legal accounting, especially in handling client funds, can damage a firm’s

providing transparency in how time is spent and allowing clients to see the detailed effort involved in their cases. Both models can contribute to client satisfaction and loyalty, depending on the clients’ preferences and expectations.

providing transparency in how time is spent and allowing clients to see the detailed effort involved in their cases. Both models can contribute to client satisfaction and loyalty, depending on the clients’ preferences and expectations.  can be beneficial for firms that consistently deliver high-quality outcomes. However, the billable hour model also rewards expertise by reflecting the time and effort required for complex and challenging cases. The appropriate pricing model may depend on the type of work and the firm’s strategy for demonstrating value to clients.

can be beneficial for firms that consistently deliver high-quality outcomes. However, the billable hour model also rewards expertise by reflecting the time and effort required for complex and challenging cases. The appropriate pricing model may depend on the type of work and the firm’s strategy for demonstrating value to clients.

person’s location was no longer as relevant as their skill set. The legal sector was going through a seismic shift of attitude.

person’s location was no longer as relevant as their skill set. The legal sector was going through a seismic shift of attitude. m north doesn’t feature. They want the best, most resilient service, the most talented and expert supplier, and their customer experience bears no relation to where we are based.

m north doesn’t feature. They want the best, most resilient service, the most talented and expert supplier, and their customer experience bears no relation to where we are based.

authorities to resolve the issue as promptly as possible.” A Law Society of England and Wales spokesperson said, “The IT outage serves as a reminder for our members to have business continuity plans in place to protect against future problems and to mitigate the impact.”

authorities to resolve the issue as promptly as possible.” A Law Society of England and Wales spokesperson said, “The IT outage serves as a reminder for our members to have business continuity plans in place to protect against future problems and to mitigate the impact.”

Microsoft Teams, or the Cashroom portal! Document management is also crucial for law firms, adopting a centralised management system can streamline processes and increase efficiency. The SRA (Solicitors Regulatory Authority) found that 75% of UK Law firms have experienced a cyber-attack in the last year, with emails being the primary target. While emails still have a place, we are seeing a shift towards the use of secure client portals for communication which both enhances clients’ experience and ensures security.

Microsoft Teams, or the Cashroom portal! Document management is also crucial for law firms, adopting a centralised management system can streamline processes and increase efficiency. The SRA (Solicitors Regulatory Authority) found that 75% of UK Law firms have experienced a cyber-attack in the last year, with emails being the primary target. While emails still have a place, we are seeing a shift towards the use of secure client portals for communication which both enhances clients’ experience and ensures security.

recording keeping. Non-compliance can result in severe penalties, loss of license and reputational damage.

recording keeping. Non-compliance can result in severe penalties, loss of license and reputational damage.  pen banking, confirmation of payee checks, automated workflows,

pen banking, confirmation of payee checks, automated workflows,

solutions seamlessly integrate with what your law firm currently uses. This adaptability ensures a smooth transition without the hassle of overhauling existing infrastructures, saving both time and resources for law firms. We use over 30 Practice Management Systems and have no hidden alliance to any – we work with the system that is best for you and your law firm.

solutions seamlessly integrate with what your law firm currently uses. This adaptability ensures a smooth transition without the hassle of overhauling existing infrastructures, saving both time and resources for law firms. We use over 30 Practice Management Systems and have no hidden alliance to any – we work with the system that is best for you and your law firm.  regulations. Clients can rest assured that their data remains secure at all times. Your data is securely stored for up to 7 years and provides a clear audit trail in line with compliance procedures. While other providers may use email communication vulnerable to cyber threats, our secure and encrypted portal is cyber essentials plus certified, providing our clients with peace of mind.

regulations. Clients can rest assured that their data remains secure at all times. Your data is securely stored for up to 7 years and provides a clear audit trail in line with compliance procedures. While other providers may use email communication vulnerable to cyber threats, our secure and encrypted portal is cyber essentials plus certified, providing our clients with peace of mind. tracking capabilities, Cashroom puts control back into the hands of law firms.

tracking capabilities, Cashroom puts control back into the hands of law firms.

g liquidity crunches and enabling firms to operate smoothly.

g liquidity crunches and enabling firms to operate smoothly. s to accurate and up-to-date information enables informed decision-making and timely intervention.

s to accurate and up-to-date information enables informed decision-making and timely intervention.

professionals to maintain a healthy work-life balance, leading to burnout and fatigue.

professionals to maintain a healthy work-life balance, leading to burnout and fatigue.

There is plenty of help available online for coping with mental health, including

There is plenty of help available online for coping with mental health, including

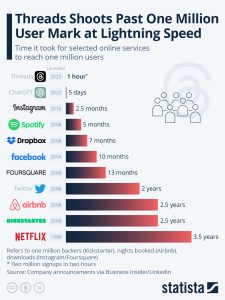

timeline for products to reach 1 million users reveals a notable acceleration over the years. In 1999, Netflix reached this milestone in 3.5 years. In contrast, Chat GBT achieved the same feat within just 5 days of its launch in 2022. Even more impressively, Threads, a competitor to Twitter, attracted 1 million users within an hour of its debut earlier this year. This rapid adoption highlights how consumers are more open to trying new products and quickly change providers if their needs are not met. Threads saw a surge in users, especially following the controversy involving Elon Musk and Twitter. It is likely that many of these 1 million users were former Twitter users looking for an alternative platform. This trend is not only relevant to tech companies but also to businesses and law firms. It is important to recognize that if service quality declines, there are other options available to consumers. Today’s consumers are more willing to explore alternatives than in the past, therefore it is crucial for law firms and businesses to adapt to retain clients and foster loyalty.

timeline for products to reach 1 million users reveals a notable acceleration over the years. In 1999, Netflix reached this milestone in 3.5 years. In contrast, Chat GBT achieved the same feat within just 5 days of its launch in 2022. Even more impressively, Threads, a competitor to Twitter, attracted 1 million users within an hour of its debut earlier this year. This rapid adoption highlights how consumers are more open to trying new products and quickly change providers if their needs are not met. Threads saw a surge in users, especially following the controversy involving Elon Musk and Twitter. It is likely that many of these 1 million users were former Twitter users looking for an alternative platform. This trend is not only relevant to tech companies but also to businesses and law firms. It is important to recognize that if service quality declines, there are other options available to consumers. Today’s consumers are more willing to explore alternatives than in the past, therefore it is crucial for law firms and businesses to adapt to retain clients and foster loyalty.

document analysis, and contract reviews. We are also witnessing the emergence of legal chatbots capable of contesting parking fines and addressing other minor legal issues. While AI-driven case production requires substantial data and effort, it offers informed outputs and analytics that would otherwise take humans hours or even days to produce.

document analysis, and contract reviews. We are also witnessing the emergence of legal chatbots capable of contesting parking fines and addressing other minor legal issues. While AI-driven case production requires substantial data and effort, it offers informed outputs and analytics that would otherwise take humans hours or even days to produce.