The Emperor’s New Clothes

Remember the fairy tale of the Emperor’s New Clothes?

A vain emperor is conned into paying a huge sum of money for a suit of new clothes, that don’t actually exist. He parades through the streets in his non-existent clothes, and the sycophantic citizens buy into the myth that he’s wearing a wonderful new set of clothes. They are afraid to call out the truth and are complicit in the lie.

But, so the story goes, a small boy shouts out “but he’s naked”, shattering the “illusion” and the Emperor is ridiculed by the previously complicit citizens.

What’s that got to do with anything?

Well, I’m beginning to think that the COVID lockdown is a bit like the little boy – shouting out to all of us “but he’s naked”. Let me explain…..!

Up until recently many businesses have been toying with remote working, thinking about it, but not really doing much. People were worried that we will miss “something” if we don’t all work from one (expensive, centrally located) office. Along comes the COVID lockdown forcing many of us to work from home, and we suddenly realise that it’s perfectly possible.

The COVID lockdown is the little boy shouting “but everybody working in that office is stupid”.

So what else might the little boy laugh at?

“Wait what … you spend hours traveling to and from work?”

I’m lucky – for the last few years my commute has been about 10mins. But I did spend years traveling in and out of Edinburgh. Nobody enjoys that – and if we no longer need to work from one centrally located office … we can all have a 30sec commute to our “office”.

“But why do you need to work then?”

And if you work remotely, from home – why do we need to work between the hours of 9-5 (or a rough approximation of those hours!)? Are we going to see working hours becoming much more flexible?

“But why does it need to wait until the weekend?”

So if working hours become more flexible, will weekends matter? If you’re working from home, with no commute and no fixed hours … why would you split a week into 5 days on and 2 off (schools I hear you say….but I suspect the little boy will be laughing at them too!)?

“So, why is it we live in this tiny house near all these other people”

Looking further ahead, the only reason cities exist is to bring people to one place allowing them to collaborate and work together. Will the little boy’s ridicule reverse the last 100 years of urbanisation? If I don’t need to work in an office, and have no fixed hours, I can live wherever I have access to a fast broadband connection!

So, you get my (somewhat laboured) point …… the COVID lockdown is forcing us to confront long held assumptions. It’s forcing us to look hard at whether the reason we held them in the first place, remains valid now.

And one last question the little boy might ask (!)

“So, why haven’t you outsourced your cash room yet?

………!

David

:

: When serving or filing at Court, you must also serve and file a hard copy of the electronic bill in “manageable” paper format. The intention is however that the electronic bill and not the paper version will be the focus on assessment, enabling live changes to reflect the Court’s assessment of costs.

When serving or filing at Court, you must also serve and file a hard copy of the electronic bill in “manageable” paper format. The intention is however that the electronic bill and not the paper version will be the focus on assessment, enabling live changes to reflect the Court’s assessment of costs.

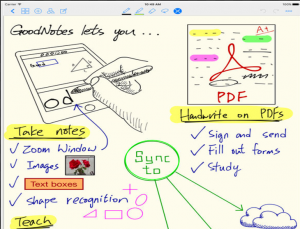

reminders. They’ve never really worked for me. For years I kept a very simple clip board on my desk, with a pad of paper, wrote down my tasks for the day and scored them out as I completed them. It worked reasonably well for the 20 years I was a practicing lawyer.

reminders. They’ve never really worked for me. For years I kept a very simple clip board on my desk, with a pad of paper, wrote down my tasks for the day and scored them out as I completed them. It worked reasonably well for the 20 years I was a practicing lawyer. OmniFocus is a Task Manager for OSX and IOS, which implements the “GTD” (Get Things Done) productivity methodology espoused in the book of the same name by David Allen. I had never come across this until I read about OmniFocus, but it’s a pretty comprehensive process for time management and (surprise surprise) getting things done.

OmniFocus is a Task Manager for OSX and IOS, which implements the “GTD” (Get Things Done) productivity methodology espoused in the book of the same name by David Allen. I had never come across this until I read about OmniFocus, but it’s a pretty comprehensive process for time management and (surprise surprise) getting things done.

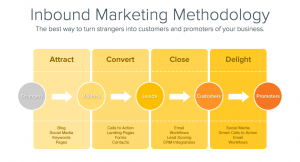

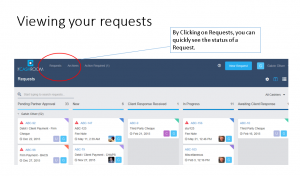

The Business Development Managers also log onto hubspot and all our new business comes in through it. David can log in and see on a dashboard very quickly how many new enquiries we have, where they came from and at what stage they are in our sales process, for example he can quickly see if Alex has sent out a contract and can then click into that if he wants to see more details.

The Business Development Managers also log onto hubspot and all our new business comes in through it. David can log in and see on a dashboard very quickly how many new enquiries we have, where they came from and at what stage they are in our sales process, for example he can quickly see if Alex has sent out a contract and can then click into that if he wants to see more details. One of the biggest issues for anyone who deals with numerous client meetings whether on the road or in the office is the whole issue of fitting in the time to type up the notes and perform the activities you’ve agreed, before the next meeting starts.

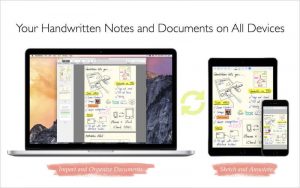

One of the biggest issues for anyone who deals with numerous client meetings whether on the road or in the office is the whole issue of fitting in the time to type up the notes and perform the activities you’ve agreed, before the next meeting starts.

It means I can still send my emails from Outlook, access documents from our Cloud, check my calendar, access anything on my desktop, use Word etc, with exactly the same look and function as if I was on a PC. The other ‘plus’ is that it’s all in the same place, which saves going in and out of various Apps. It is certainly a long way from when I first got an iPad, and you couldn’t use Microsoft programmes at all, or at least it certainly wasn’t easy to do so! I can’t imagine ever going back to a laptop now, let alone a PC!!

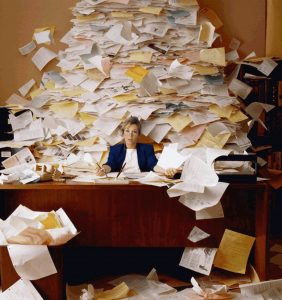

It means I can still send my emails from Outlook, access documents from our Cloud, check my calendar, access anything on my desktop, use Word etc, with exactly the same look and function as if I was on a PC. The other ‘plus’ is that it’s all in the same place, which saves going in and out of various Apps. It is certainly a long way from when I first got an iPad, and you couldn’t use Microsoft programmes at all, or at least it certainly wasn’t easy to do so! I can’t imagine ever going back to a laptop now, let alone a PC!! legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly. CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea.

CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea. Fear of change

Fear of change

Lack of skills

Lack of skills Miles Duncan is CEO and Founder

Miles Duncan is CEO and Founder