Prioritising Mental Health in the Legal Industry

Why It Matters More Than Ever

Mental Health Awareness Week is an important moment to pause and reflect on the well-being of those around us—and ourselves. In high-pressure industries like legal services, where demanding workloads and tight deadlines are the norm, prioritising mental health is no longer a ‘nice-to-have’ but an essential part of building a sustainable, people-first business.

At Cashroom, we understand that promoting mental health goes hand in hand with promoting a supportive and thriving workplace. The legal sector presents unique challenges—long hours, emotionally charged cases, and the constant pressure for precision—which can significantly impact mental well-being. Left unaddressed, this can lead to stress, burnout, and even long-term health issues.

Building a Healthier Legal Workplace

To create a sustainable and thriving legal industry, firms should look at prioritising mental health as part of their culture. This goes beyond offering token gestures—it requires meaningful, ongoing action.

Flexible working practices are one way to support well-being. By allowing legal professionals more autonomy over their schedules, firms can help reduce burnout and promote a healthier work-life balance. This flexibility is especially important in a sector where long hours are often the norm.

Firms should also promote open dialogue around mental health, creating an environment where employees feel comfortable seeking support without fear of stigma. Whether through mental health champions, regular check-ins, or employee assistance programmes, proactive support systems can make a real difference.

Additionally, firms could consider mental health training for managers. Equipping leaders with the skills to recognise signs of stress and support their teams effectively helps create a workplace where well-being is prioritised.

Practical Tips for Protecting Your Mental Health

For those working in the legal sector, protecting your mental health is just as important as meeting deadlines. Setting clear boundaries between work and personal time can make a world of difference—whether that means switching off emails after hours or committing to regular breaks during the day.

Taking even a few minutes away from your desk for a short walk or a moment of mindfulness can improve focus and reduce stress levels. And if you’re struggling, reaching out to a trusted colleague, manager, or mental health professional is a sign of strength, not weakness.

Finally, never underestimate the power of self-care. Engaging in activities that bring you joy—whether it’s exercise, reading, or simply spending time with loved ones—helps recharge both your mind and body.

Let’s Keep the Conversation Going

This Mental Health Awareness Week, we encourage everyone to check in with colleagues, offer support, and be kind to themselves. Mental health is not a one-week conversation; it’s something we must prioritise every day. At Cashroom, we remain committed to creating a workplace where people feel valued, supported, and empowered to thrive—both professionally and personally.

If you or someone you know is struggling with their mental health, don’t hesitate to seek support. You are not alone.

Where to Find Support

LawCare – Provides free, confidential support for legal professionals dealing with mental health issues.

Samaritans – 24/7 support for anyone in emotional distress.

Mind – Mental health charity offering information, support, and advice.

Shout – Free, confidential 24/7 text support for anyone struggling to cope. Text SHOUT to 85258

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

“Cashroom has been instrumental in transforming our financial processes. Their expertise in handling both Private and Legal Aid finances, migrating us to LEAP/Xero, and streamlining expense management has made a real difference. The Cashroom Portal has also been a game-changer, giving us real-time access to financial data, improving security, and making communication seamless. We now have greater efficiency, accuracy, and peace of mind knowing our accounts are in expert hands.”

Cashroom

Cashroom

Can you tell us how Cashroom is supporting this?

Can you tell us how Cashroom is supporting this?

Catherine O’Day, Founder and Non Exec Director

Catherine O’Day, Founder and Non Exec Director

There was real interest and excitement for the event and on 30th January a group of around 20 of us gathered at

There was real interest and excitement for the event and on 30th January a group of around 20 of us gathered at

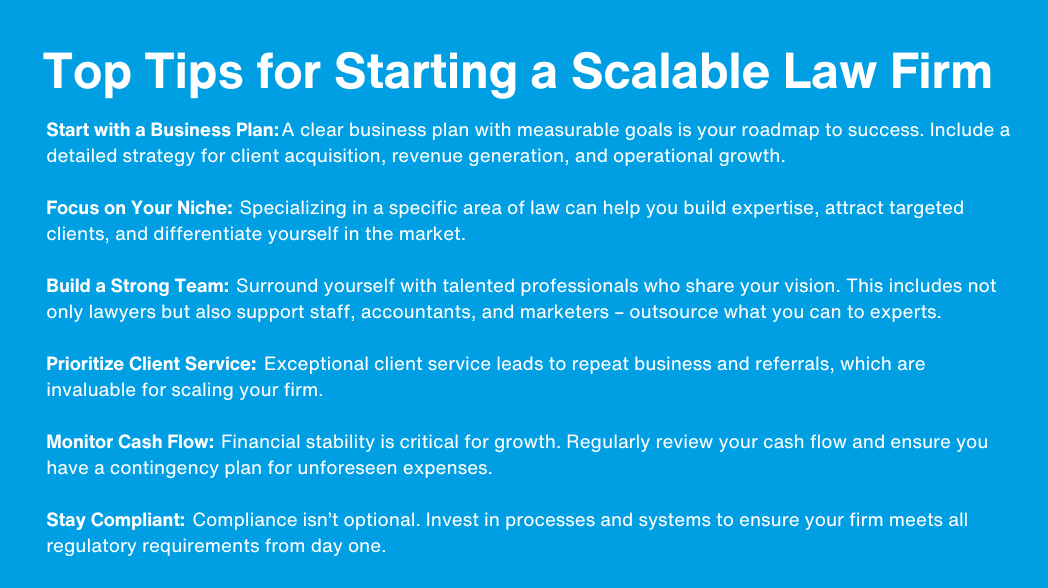

change will bring. Defining why this change matters and how it will impact the firm sets a solid foundation. For example, if the change involves new technology for case management, explain how it will streamline client onboarding, improve document access, or enhance workflow efficiency. Engaging stakeholders early in the process—such as senior partners and department heads—ensures that key figures are aligned and supportive from the beginning. They can help communicate the vision consistently, reinforcing it across the firm to build understanding and enthusiasm.

change will bring. Defining why this change matters and how it will impact the firm sets a solid foundation. For example, if the change involves new technology for case management, explain how it will streamline client onboarding, improve document access, or enhance workflow efficiency. Engaging stakeholders early in the process—such as senior partners and department heads—ensures that key figures are aligned and supportive from the beginning. They can help communicate the vision consistently, reinforcing it across the firm to build understanding and enthusiasm.

A great starting point is to take stock of your firm’s financial health. Reviewing your performance from 2024 allows you to understand what went well and where

A great starting point is to take stock of your firm’s financial health. Reviewing your performance from 2024 allows you to understand what went well and where