2024 Cashroom Round Up

As 2024 draws to a close, we’re looking back on an incredible year of growth, innovation, and achievements at Cashroom. From launching game-changing features and celebrating team milestones to expanding our services and earning industry recognition, this year has truly been an impactful one.

Leadership Milestones and Cashroom Growth

A highlight of the year for our leadership team was celebrating a decade with Cashroom for CEO Chris O’Day and CRO Alex Holt. Their vision, dedication, and commitment to client success have shaped Cashroom into a trusted  partner for law firms across the UK, and we are profoundly grateful for their leadership.

partner for law firms across the UK, and we are profoundly grateful for their leadership.

We have been delighted to welcome many new clients into the Cashroom family in 2024, expanding our reputation for exceptional legal cashiering and financial management services. Our team has also grown, with talented new hires joining key areas to enhance our client support and maintain our high service standards.

Innovative Product Launches

A highlight of 2024 was the official launch of our Confirmation of Payee feature, a crucial addition that helps prevent payment errors by verifying payee details before funds are transferred. This feature has strengthened the security and accuracy of financial transactions for our clients, reducing fraud risks and ensuring smoother payment workflows for law firms.

strengthened the security and accuracy of financial transactions for our clients, reducing fraud risks and ensuring smoother payment workflows for law firms.

We also rolled out our Matter Look-Up functionality, allowing more clients to access matters within our portal integrating with their Practice Management System. This feature boosts integration and accessibility, making it easier for firms to manage financials and case details seamlessly streamlining workflows and increasing efficiency.

Celebrating Recognition Across the Industry

This year, we were privileged to attend industry events and award shows throughout the UK, providing us with invaluable opportunities to connect with clients, partners, and peers in the legal sector. A particular highlight was being named Winners of Excellence in Legal Technology at the Scottish Legal Awards. This was a massive achievement for Cashroom to be honoured by the Scottish legal community. In addition, we were honoured to be:

- Highly Commended for Best Use of Technology at the British Wills and Probate Awards

- Highly Commended for Best Use of Technology at the Modern Law Conveyancing Awards

- Highly Commended for BD Professional of the Year, awarded to our CRO, Alex Holt

Being recognised is always an honour, and we are excited to keep pushing the boundaries of innovation in legal finance.

Looking Ahead To 2025

As we look ahead to 2025, we are already preparing for another year of success. With new advancements in the works, ongoing improvements to our services, and a growing team of passionate professionals, we are set to make 2025 another exciting chapter in the Cashroom journey.

To our clients, partners, and team members – thank you for being part of this amazing year. We look forward to supporting your financial needs and helping you achieve even greater success in the coming year.

Happy Christmas, and here’s to an even brighter 2025!

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

cards, consider tailoring messages to individual clients, acknowledging shared successes or milestones from the past year. Consider gifting clients something thoughtful yet professional. Whether it’s a donation to a charity in their name, a book related to their interests, or a festive treat from a local business, a personal touch reflects your appreciation and can leave a lasting positive impression of your firm.

cards, consider tailoring messages to individual clients, acknowledging shared successes or milestones from the past year. Consider gifting clients something thoughtful yet professional. Whether it’s a donation to a charity in their name, a book related to their interests, or a festive treat from a local business, a personal touch reflects your appreciation and can leave a lasting positive impression of your firm.  bonuses, team recognition awards, or a simple thank-you message from firm leadership, acknowledging the contributions of every member is key to boosting morale. Encouraging your team to take a break from their usual routines by organising a holiday event such as an office party can create a sense of solidarity, helping staff relax and bond in a low-pressure environment.

bonuses, team recognition awards, or a simple thank-you message from firm leadership, acknowledging the contributions of every member is key to boosting morale. Encouraging your team to take a break from their usual routines by organising a holiday event such as an office party can create a sense of solidarity, helping staff relax and bond in a low-pressure environment.

But leading on from that- is the work we win good quality? Is there a risk that we are in a sector that has ever decreasing margin? Or is it a sector where a huge amount of very high quality work can be done, but there may be a long tail before billing can happen. Cashflow risks right there!

But leading on from that- is the work we win good quality? Is there a risk that we are in a sector that has ever decreasing margin? Or is it a sector where a huge amount of very high quality work can be done, but there may be a long tail before billing can happen. Cashflow risks right there!

reassurance, and peace of mind. Whether it’s helping a family buy their first home, advising a business through a complex contract, or representing someone in court, your role as a trusted advisor is irreplaceable.

reassurance, and peace of mind. Whether it’s helping a family buy their first home, advising a business through a complex contract, or representing someone in court, your role as a trusted advisor is irreplaceable. Show empathy by acknowledging their concerns and providing clear, compassionate advice. In doing so, you’ll build a stronger bond with your clients and help ease their anxiety.

Show empathy by acknowledging their concerns and providing clear, compassionate advice. In doing so, you’ll build a stronger bond with your clients and help ease their anxiety.

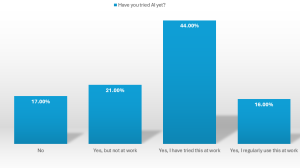

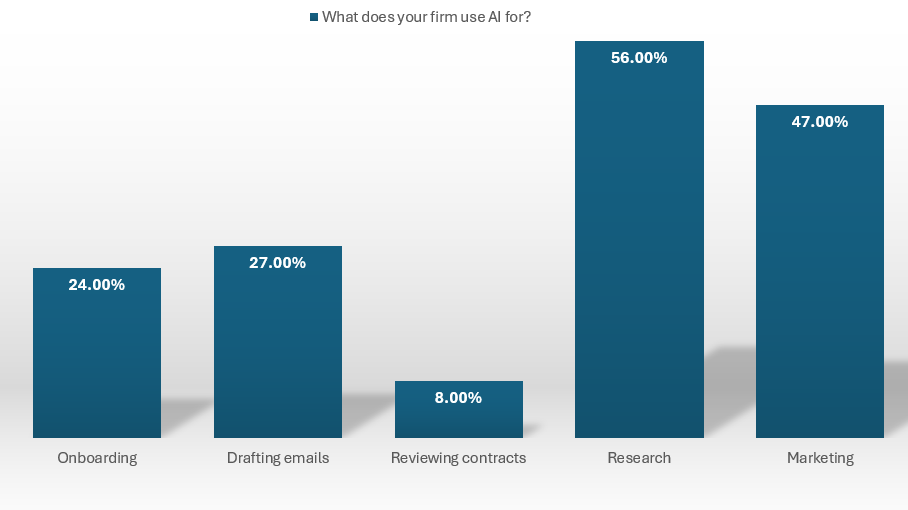

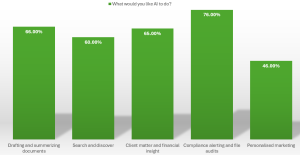

When Law Firm Ambition asked what firms would like AI to handle, 76% of respondents indicated compliance alerting and file audits, 66% wanted drafting and summarising documents, and 65% sought client matter and financial insights. As AI technology advances, it will likely expand its capabilities across these areas, becoming an indispensable tool for modern law practice.

When Law Firm Ambition asked what firms would like AI to handle, 76% of respondents indicated compliance alerting and file audits, 66% wanted drafting and summarising documents, and 65% sought client matter and financial insights. As AI technology advances, it will likely expand its capabilities across these areas, becoming an indispensable tool for modern law practice.

ensure compliance processes are followed with precision and accuracy, ensuring that all processes align with your regulatory requirements. Our technology allows for real-time monitoring and reporting, providing law firms with full visibility over their financial operations.

ensure compliance processes are followed with precision and accuracy, ensuring that all processes align with your regulatory requirements. Our technology allows for real-time monitoring and reporting, providing law firms with full visibility over their financial operations.

and reconcile your accounts from the previous year. This process can be time-consuming, and the more disorganised your books are, the longer it will take to get them in a healthy state. By acting early, you can avoid this backlog and ensure your books are ready for the new year from day one.

and reconcile your accounts from the previous year. This process can be time-consuming, and the more disorganised your books are, the longer it will take to get them in a healthy state. By acting early, you can avoid this backlog and ensure your books are ready for the new year from day one. The best way to ensure a smooth start to the new year is to sign your outsourcing contract as early as possible. This gives your new bookkeeping partner time to assess your firm’s financial situation and start cleaning up your accounts before January. It also gives your team time to adjust to the new system and processes, ensuring that everything is in order and that work can begin immediately in the new year. Cashroom offer a full onboarding service and training for your staff, so they are confident with our portal, to minimize disruption and ensure a smooth transition from the start.

The best way to ensure a smooth start to the new year is to sign your outsourcing contract as early as possible. This gives your new bookkeeping partner time to assess your firm’s financial situation and start cleaning up your accounts before January. It also gives your team time to adjust to the new system and processes, ensuring that everything is in order and that work can begin immediately in the new year. Cashroom offer a full onboarding service and training for your staff, so they are confident with our portal, to minimize disruption and ensure a smooth transition from the start.

You’ve probably been there. You get an email, a phone call, or maybe a referral that feels promising. The prospect seems interested, perhaps even eager to move forward with your legal expertise. Maybe it’s a potential corporate client with a juicy case or a high-net-worth individual looking for good quality estate

You’ve probably been there. You get an email, a phone call, or maybe a referral that feels promising. The prospect seems interested, perhaps even eager to move forward with your legal expertise. Maybe it’s a potential corporate client with a juicy case or a high-net-worth individual looking for good quality estate

financial insights. The integration of this technology into your practice ensures that all financial data is accurate, up-to-date, and easily accessible when needed. Whether you’re operating on a cobweb covered old PMS or a more modern cutting-edge software, at Cashroom our system agnostic approach means we can help and provide true expertise.

financial insights. The integration of this technology into your practice ensures that all financial data is accurate, up-to-date, and easily accessible when needed. Whether you’re operating on a cobweb covered old PMS or a more modern cutting-edge software, at Cashroom our system agnostic approach means we can help and provide true expertise.  In the spirit of Halloween, it’s easy to see poor accounting as a monster waiting to sabotage your law firm’s success. But just as every haunted house has an escape route, your firm can avoid these terrifying pitfalls by partnering with an expert service provider like Cashroom. With benefits ranging from cost savings to compliance security, outsourcing legal accounting allows your firm to focus on what matters most – serving your clients and growing your practice.

In the spirit of Halloween, it’s easy to see poor accounting as a monster waiting to sabotage your law firm’s success. But just as every haunted house has an escape route, your firm can avoid these terrifying pitfalls by partnering with an expert service provider like Cashroom. With benefits ranging from cost savings to compliance security, outsourcing legal accounting allows your firm to focus on what matters most – serving your clients and growing your practice.

biggest pain point is often

biggest pain point is often

next webinar in November “Current AI and Automation in Law Firms”

next webinar in November “Current AI and Automation in Law Firms”

Mindfulness is a practice that helps you focus on the present moment and reduce stress. Whether through meditation, breathing exercises, or simply taking a few moments to be still, mindfulness can help you stay grounded and improve your emotional resilience.

Mindfulness is a practice that helps you focus on the present moment and reduce stress. Whether through meditation, breathing exercises, or simply taking a few moments to be still, mindfulness can help you stay grounded and improve your emotional resilience.

Happy clients can be helpful in strategic ways – case studies and testimonials on collateral and on websites can be very powerful. Even more valuable are those wonderful clients who will take reference calls with prospective clients- often forming a clinching element as they expound the benefits of what we do to a buyer who sees that endorsement as a final factor before signing.

Happy clients can be helpful in strategic ways – case studies and testimonials on collateral and on websites can be very powerful. Even more valuable are those wonderful clients who will take reference calls with prospective clients- often forming a clinching element as they expound the benefits of what we do to a buyer who sees that endorsement as a final factor before signing. forget our own staff- happy clients create happy staff, and vice versa. Working for people who like what we do is a much more pleasant experience. Not to mention the fact that happy clients stay with you- in our case for many years. Client retention is one of the best indicators of client satisfaction.

forget our own staff- happy clients create happy staff, and vice versa. Working for people who like what we do is a much more pleasant experience. Not to mention the fact that happy clients stay with you- in our case for many years. Client retention is one of the best indicators of client satisfaction. Cashroom is the UK’s premier choice for outsourced legal

Cashroom is the UK’s premier choice for outsourced legal

Mismanagement of client funds can lead to severe penalties, including fines, suspension, or even disbarment. The hidden cost here lies in the

Mismanagement of client funds can lead to severe penalties, including fines, suspension, or even disbarment. The hidden cost here lies in the  Errors in legal accounting, especially in handling client funds, can damage a firm’s

Errors in legal accounting, especially in handling client funds, can damage a firm’s

providing transparency in how time is spent and allowing clients to see the detailed effort involved in their cases. Both models can contribute to client satisfaction and loyalty, depending on the clients’ preferences and expectations.

providing transparency in how time is spent and allowing clients to see the detailed effort involved in their cases. Both models can contribute to client satisfaction and loyalty, depending on the clients’ preferences and expectations.  can be beneficial for firms that consistently deliver high-quality outcomes. However, the billable hour model also rewards expertise by reflecting the time and effort required for complex and challenging cases. The appropriate pricing model may depend on the type of work and the firm’s strategy for demonstrating value to clients.

can be beneficial for firms that consistently deliver high-quality outcomes. However, the billable hour model also rewards expertise by reflecting the time and effort required for complex and challenging cases. The appropriate pricing model may depend on the type of work and the firm’s strategy for demonstrating value to clients.

person’s location was no longer as relevant as their skill set. The legal sector was going through a seismic shift of attitude.

person’s location was no longer as relevant as their skill set. The legal sector was going through a seismic shift of attitude. m north doesn’t feature. They want the best, most resilient service, the most talented and expert supplier, and their customer experience bears no relation to where we are based.

m north doesn’t feature. They want the best, most resilient service, the most talented and expert supplier, and their customer experience bears no relation to where we are based.

authorities to resolve the issue as promptly as possible.” A Law Society of England and Wales spokesperson said, “The IT outage serves as a reminder for our members to have business continuity plans in place to protect against future problems and to mitigate the impact.”

authorities to resolve the issue as promptly as possible.” A Law Society of England and Wales spokesperson said, “The IT outage serves as a reminder for our members to have business continuity plans in place to protect against future problems and to mitigate the impact.”