Does your firm have a plan for its future?

At The Cashroom, we have recently started extensive training programmes for our ‘Rising Stars’ and ‘Future Leaders’. The initiative is aimed at identifying key people for the future success of the business, and to start developing them to ensure they are able to perform and thrive when the time comes to step up the ladder. It made me think about my time in practice as a Solicitor, and the fact that I never came across any such deliberate and  detailed plan for the future. Sure, there were appraisals and performance reviews which set goals, and identified areas for improvement, but they were concerned more with performing better in your current role, rather than planning and preparing for future roles, and areas of interest. Have a think for moment – does your firm have a plan for developing its key people for the future?

detailed plan for the future. Sure, there were appraisals and performance reviews which set goals, and identified areas for improvement, but they were concerned more with performing better in your current role, rather than planning and preparing for future roles, and areas of interest. Have a think for moment – does your firm have a plan for developing its key people for the future?

I deliberately say key ‘people’ because although you must plan for the future ownership of the business via the next batch of Partners, it is just as crucial that you plan for key staff, and older Partners too. The partnership agreement may provide a set retirement age, but retaining people as Consultants or Ambassadors for the firm beyond that may be crucial for retaining certain longstanding clients who have worked with that person for many years. Equally, Paralegals or Support Staff may have the deepest understanding of certain clients, or may be the ones who are in regular contact with them on an ongoing basis.

When developing these key people for the future, it is also crucial to find out what they want and aim for in their working lives. When was the last time you asked your staff what their career aspirations were? There are many reasons to do so – for starters, if you can’t offer what they are aiming for, they will leave at some point, and you need to know that. Secondly, the future wellbeing of your firm will need people to take care of the different areas of the business – not just the practice of law – so you need to find out if you have people who have an interest in being, for example, ‘Business Development Partner/Manager/Director’, ‘Client Relations/Complaints Partner’, ‘Cashroom Manager / COLP / COFA’, or ‘Managing Partner’. It is important to find and develop these people over a period of time, and also to think about these role specifications clearly so you are not setting people up for a fall. All too often, particularly the role of Managing Partner, is given to somebody without enough regard for whether they are the best person for the role, what the firm expects of them by way of splitting their time between fee earning and management commitments and, crucially, any sort of plan as to how they would return to a full time fee earning Partner role thereafter.

So, perhaps there is some food for thought here for discussion at your next Partners meeting. Do you have the same people in mind to take over the reins, and how are you going to equip them with the skills to do so? I would suggest putting a realistic plan together, with clear and achievable objectives, put it in to practice as soon as possible, and keep in regular dialogue with the people involved. They will likely be motivated by the opportunity, bringing better engagement immediately, and more seamless business continuity and succession into the future.

So, perhaps there is some food for thought here for discussion at your next Partners meeting. Do you have the same people in mind to take over the reins, and how are you going to equip them with the skills to do so? I would suggest putting a realistic plan together, with clear and achievable objectives, put it in to practice as soon as possible, and keep in regular dialogue with the people involved. They will likely be motivated by the opportunity, bringing better engagement immediately, and more seamless business continuity and succession into the future.

Gregor Angus, Senior Business Development Manager

The Cashroom Ltd

Do you have all your eggs in one basket?

Do you have all your eggs in one basket? Getting the best from a pension

Getting the best from a pension Perhaps some sound advice would be to pause for breath the next time a client asks your professional view on something outside your area of expertise. Is there a colleague who may be better placed to advise? Is there another friendly firm who would look after your client for this particular matter, but not poach them for future work? Perhaps you are part of a network such as the

Perhaps some sound advice would be to pause for breath the next time a client asks your professional view on something outside your area of expertise. Is there a colleague who may be better placed to advise? Is there another friendly firm who would look after your client for this particular matter, but not poach them for future work? Perhaps you are part of a network such as the  knowledge, it could potentially be dangerous for a number of reasons. For example, are you up to speed with the latest cyber fraud tactics? Are you fully aware of what your employees’ rights and responsibilities are from an HR perspective? Or is trying to do your own cashiering going to land you in hot water at a compliance inspection/audit. With all of these examples, you may ‘think’ you know what you are doing, or that you can get by, but do you “know’ what you are doing? If not, the additional time you’re spending on them, not to mention the stress, probably more than justifies delegating to somebody better placed to deal with them, or outsourcing those responsibilities to experienced experts or third-party providers. That way, you can sleep at night knowing things are being done properly, that you are covered from an insurance point of you, and just as importantly, that you can focus on what you do best, whether that be generating new business for your firm, or doing fee earning work for clients. I hope there is some food for thought here, and some take away points to discuss at your next Partners meeting.

knowledge, it could potentially be dangerous for a number of reasons. For example, are you up to speed with the latest cyber fraud tactics? Are you fully aware of what your employees’ rights and responsibilities are from an HR perspective? Or is trying to do your own cashiering going to land you in hot water at a compliance inspection/audit. With all of these examples, you may ‘think’ you know what you are doing, or that you can get by, but do you “know’ what you are doing? If not, the additional time you’re spending on them, not to mention the stress, probably more than justifies delegating to somebody better placed to deal with them, or outsourcing those responsibilities to experienced experts or third-party providers. That way, you can sleep at night knowing things are being done properly, that you are covered from an insurance point of you, and just as importantly, that you can focus on what you do best, whether that be generating new business for your firm, or doing fee earning work for clients. I hope there is some food for thought here, and some take away points to discuss at your next Partners meeting. 3. Some employers are fortunate to have deep pockets, or access to investment cash for wellbeing, allowing them to invest in a gym in the office, subsidise gym memberships, or have personal trainers or dieticians come in to the office regularly. However, you really don’t need to go to that extent to encourage your employees to spend a bit more time moving and exercising regularly during their working day, thereby improving their wellness. How about encouraging walking meetings: a brisk 10 – 15 minutes round the block to chat through something you would normally do while sitting slumped in a meeting room to do. You will likely arrive back in the office refreshed, or at least a little more awake, and ready for the next task. Top tip – an initiative like this requires a top-down adoption, i.e. the leaders and managers of the business need to embrace it and start doing it regularly, to help instil into more junior staff that it is acceptable, and in fact is to be encouraged!

3. Some employers are fortunate to have deep pockets, or access to investment cash for wellbeing, allowing them to invest in a gym in the office, subsidise gym memberships, or have personal trainers or dieticians come in to the office regularly. However, you really don’t need to go to that extent to encourage your employees to spend a bit more time moving and exercising regularly during their working day, thereby improving their wellness. How about encouraging walking meetings: a brisk 10 – 15 minutes round the block to chat through something you would normally do while sitting slumped in a meeting room to do. You will likely arrive back in the office refreshed, or at least a little more awake, and ready for the next task. Top tip – an initiative like this requires a top-down adoption, i.e. the leaders and managers of the business need to embrace it and start doing it regularly, to help instil into more junior staff that it is acceptable, and in fact is to be encouraged! 5. Finally, make seasonal events (e.g Easter, Halloween, Christmas) fun! Think about giving out Advent Calendars or Easter Eggs to all staff – not a huge investment, but definitely a morale booster – or having a dress down/up(!) day for Halloween. This can encourage interaction amongst employees, lift spirits in the office, and at the same time be used to generate some money for a charity of your choice.

5. Finally, make seasonal events (e.g Easter, Halloween, Christmas) fun! Think about giving out Advent Calendars or Easter Eggs to all staff – not a huge investment, but definitely a morale booster – or having a dress down/up(!) day for Halloween. This can encourage interaction amongst employees, lift spirits in the office, and at the same time be used to generate some money for a charity of your choice. There are catastrophic implications of not defending against data breaches and cybercrime. But, before you can put stringent security processes in place, you have to understand the risks.

There are catastrophic implications of not defending against data breaches and cybercrime. But, before you can put stringent security processes in place, you have to understand the risks. Property hijackings (where criminals pose as owners) are escalating. In many cases, criminals will rent a property and steal the landlord’s post. They then use this to pose as the real owner and sell the house to cash buyers.

Property hijackings (where criminals pose as owners) are escalating. In many cases, criminals will rent a property and steal the landlord’s post. They then use this to pose as the real owner and sell the house to cash buyers. Malware attacks – where malicious software is installed on a user’s machine – can be extremely damaging; to your day-to-day operations, your reputation, and your bottom line. Ransomware attacks – an aggressive form of malware which prevents access to systems unless a payment is made – can be even worse.

Malware attacks – where malicious software is installed on a user’s machine – can be extremely damaging; to your day-to-day operations, your reputation, and your bottom line. Ransomware attacks – an aggressive form of malware which prevents access to systems unless a payment is made – can be even worse. Information security certification (e.g. ISO 27001 or Cyber Essentials) helps to protect client and employee data. This won’t just keep sensitive data secure, it will also demonstrate to clients (and the ICO) that you take your responsibilities seriously.

Information security certification (e.g. ISO 27001 or Cyber Essentials) helps to protect client and employee data. This won’t just keep sensitive data secure, it will also demonstrate to clients (and the ICO) that you take your responsibilities seriously. At

At  Outsourcing to The Cashroom has been painless. So easy to deal with accommodating everything that we need to do, when we need to do it, whilst keeping us on the right side of the vast array of regulations.

Outsourcing to The Cashroom has been painless. So easy to deal with accommodating everything that we need to do, when we need to do it, whilst keeping us on the right side of the vast array of regulations.  At the same time, the total cost of employing in-house cashiering personnel is expensive. Because, in addition to wages, you also have to take the costs of recruitment, induction, training, mentoring, sick pay, maternity cover, holiday cover, pension contributions, and National Insurance into consideration.

At the same time, the total cost of employing in-house cashiering personnel is expensive. Because, in addition to wages, you also have to take the costs of recruitment, induction, training, mentoring, sick pay, maternity cover, holiday cover, pension contributions, and National Insurance into consideration. The Cashroom offer an invaluable service for any solicitor’s firm. Their approach is efficient, professional and responsive. They have allowed us to deal with rapid growth by taking on all accounts functionality.”

The Cashroom offer an invaluable service for any solicitor’s firm. Their approach is efficient, professional and responsive. They have allowed us to deal with rapid growth by taking on all accounts functionality.” The Cashroom has definitely been a good business move, not only because of efficiency but also in relation to compliance which can be daunting at times.”

The Cashroom has definitely been a good business move, not only because of efficiency but also in relation to compliance which can be daunting at times.” We operate a business which requires efficiency and certainty of service. The Cashroom has augmented our own internal accounts team, taking control of key elements and working closely to provide a seamless service to us.

We operate a business which requires efficiency and certainty of service. The Cashroom has augmented our own internal accounts team, taking control of key elements and working closely to provide a seamless service to us.  How quickly can you get up and running?

How quickly can you get up and running? We have been using The Cashroom’s services for three years now. We brought them in to provide a secure, efficient, compliant cashiering function to support our growing business with their flexible resource model.

We have been using The Cashroom’s services for three years now. We brought them in to provide a secure, efficient, compliant cashiering function to support our growing business with their flexible resource model.  We do not have a ‘system’ or software that we use, we simply access the accounts part of your existing Practice Management System remotely. So, all you need is a legal practice management system of some sort, and a means of us accessing it remotely. We also have a secure client portal which all of our clients are on, creating a secure environment for both The Cashroom and client to communicate without the cyber risks of email. This also avoids having to protect sensitive data via email. Training can also be given to ensure you are comfortable when using the portal.

We do not have a ‘system’ or software that we use, we simply access the accounts part of your existing Practice Management System remotely. So, all you need is a legal practice management system of some sort, and a means of us accessing it remotely. We also have a secure client portal which all of our clients are on, creating a secure environment for both The Cashroom and client to communicate without the cyber risks of email. This also avoids having to protect sensitive data via email. Training can also be given to ensure you are comfortable when using the portal. We allocate each client to a cashiering team, headed up by a very experienced senior cashier, essentially your ‘Head Cashier’. They will have a small team of people who will work with your firm, in order that holidays, sickness cover etc, are not a problem for you. You will get to know the two or three people working with your firm very quickly, and build a relationship with them. You can pick up the phone or send a query via our secure client portal to these selected people at any point and be ensured that someone will always be about to help.

We allocate each client to a cashiering team, headed up by a very experienced senior cashier, essentially your ‘Head Cashier’. They will have a small team of people who will work with your firm, in order that holidays, sickness cover etc, are not a problem for you. You will get to know the two or three people working with your firm very quickly, and build a relationship with them. You can pick up the phone or send a query via our secure client portal to these selected people at any point and be ensured that someone will always be about to help. change makes the difference between whether you sink or swim. One way that savvy firms are choosing to adapt is by outsourcing essential business tasks, like legal cashiering.

change makes the difference between whether you sink or swim. One way that savvy firms are choosing to adapt is by outsourcing essential business tasks, like legal cashiering. Maximise your resource: Benefit from a cost based on the actual activity and skill level your firm requires, rather than having to fund sufficient senior cashiering resource to deal with complex, high-risk elements, while using that same resource to carry out the more mundane, junior tasks.

Maximise your resource: Benefit from a cost based on the actual activity and skill level your firm requires, rather than having to fund sufficient senior cashiering resource to deal with complex, high-risk elements, while using that same resource to carry out the more mundane, junior tasks.  addressing. According to research 66% of solicitors feel high levels of stress in their jobs, and each year in the UK, 70 million workdays are lost to mental illness.

addressing. According to research 66% of solicitors feel high levels of stress in their jobs, and each year in the UK, 70 million workdays are lost to mental illness. Almost half of all the calls received (48%) were made by legal professionals with less than five years’ qualified experience. The Junior Lawyers Division’s resilience and well-being survey also found a huge number of younger legal professionals struggling with work related mental health issues. This research clearly shows that the well-being of people in the legal sector spans all knowledge ranges and doesn’t discriminate between the newly qualified and the more experienced lawyer.

Almost half of all the calls received (48%) were made by legal professionals with less than five years’ qualified experience. The Junior Lawyers Division’s resilience and well-being survey also found a huge number of younger legal professionals struggling with work related mental health issues. This research clearly shows that the well-being of people in the legal sector spans all knowledge ranges and doesn’t discriminate between the newly qualified and the more experienced lawyer. 40% reduction in new buyer enquiries. Although the net balance figures for March, April and May were slightly more buoyant with only a -26% net balance of new buyer enquiries. It’s clear that buyers are reluctant to declare an interest in property until October 31st when they know what the country is doing next.

40% reduction in new buyer enquiries. Although the net balance figures for March, April and May were slightly more buoyant with only a -26% net balance of new buyer enquiries. It’s clear that buyers are reluctant to declare an interest in property until October 31st when they know what the country is doing next. There is light at the end of the Brexit tunnel, and we’re not talking about deal or no deal. Reports have suggested that transactions are slowly starting to pick up. The number of approved sales per branch were eight in April, an increase on the seven per branch the previous month.

There is light at the end of the Brexit tunnel, and we’re not talking about deal or no deal. Reports have suggested that transactions are slowly starting to pick up. The number of approved sales per branch were eight in April, an increase on the seven per branch the previous month. Under the new rules the concept of unpaid or incurred disbursements has been removed, meaning disbursements are only to be considered as disbursements when paid.

Under the new rules the concept of unpaid or incurred disbursements has been removed, meaning disbursements are only to be considered as disbursements when paid. extremely busy and sometime stressful work we all have commitments and strains to deal with in our personal life too. It is vital for all of us to take a step back when needed and deal with our own health. And even if we do not have any existing mental health problems, ensure that we are all looking after our mental health as we do our physical health.

extremely busy and sometime stressful work we all have commitments and strains to deal with in our personal life too. It is vital for all of us to take a step back when needed and deal with our own health. And even if we do not have any existing mental health problems, ensure that we are all looking after our mental health as we do our physical health. At The Cashroom we have a confidential phone line available to staff which goes to trained mental health professionals that they can call 24 hours a day (you wouldn’t let yourself or even a colleague treat your cancer would you?).The Mindful Employer creates a safe place for staff to call and also has a lot of useful information on its website for staff. We also encourage all staff to look after their mental wellbeing by allowing time during the working day for staff to complete a daily mile outside in the fresh air and we have fresh fruit delivered weekly. We also have our mental health charter displayed in the office for staff to see.

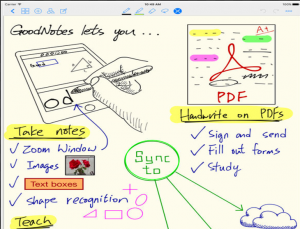

At The Cashroom we have a confidential phone line available to staff which goes to trained mental health professionals that they can call 24 hours a day (you wouldn’t let yourself or even a colleague treat your cancer would you?).The Mindful Employer creates a safe place for staff to call and also has a lot of useful information on its website for staff. We also encourage all staff to look after their mental wellbeing by allowing time during the working day for staff to complete a daily mile outside in the fresh air and we have fresh fruit delivered weekly. We also have our mental health charter displayed in the office for staff to see. reminders. They’ve never really worked for me. For years I kept a very simple clip board on my desk, with a pad of paper, wrote down my tasks for the day and scored them out as I completed them. It worked reasonably well for the 20 years I was a practicing lawyer.

reminders. They’ve never really worked for me. For years I kept a very simple clip board on my desk, with a pad of paper, wrote down my tasks for the day and scored them out as I completed them. It worked reasonably well for the 20 years I was a practicing lawyer. OmniFocus is a Task Manager for OSX and IOS, which implements the “GTD” (Get Things Done) productivity methodology espoused in the book of the same name by David Allen. I had never come across this until I read about OmniFocus, but it’s a pretty comprehensive process for time management and (surprise surprise) getting things done.

OmniFocus is a Task Manager for OSX and IOS, which implements the “GTD” (Get Things Done) productivity methodology espoused in the book of the same name by David Allen. I had never come across this until I read about OmniFocus, but it’s a pretty comprehensive process for time management and (surprise surprise) getting things done.

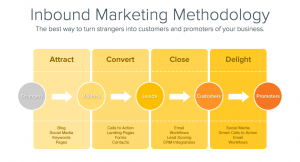

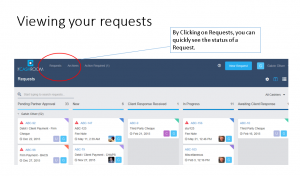

The Business Development Managers also log onto hubspot and all our new business comes in through it. David can log in and see on a dashboard very quickly how many new enquiries we have, where they came from and at what stage they are in our sales process, for example he can quickly see if Alex has sent out a contract and can then click into that if he wants to see more details.

The Business Development Managers also log onto hubspot and all our new business comes in through it. David can log in and see on a dashboard very quickly how many new enquiries we have, where they came from and at what stage they are in our sales process, for example he can quickly see if Alex has sent out a contract and can then click into that if he wants to see more details. One of the biggest issues for anyone who deals with numerous client meetings whether on the road or in the office is the whole issue of fitting in the time to type up the notes and perform the activities you’ve agreed, before the next meeting starts.

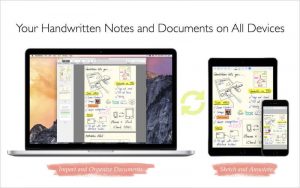

One of the biggest issues for anyone who deals with numerous client meetings whether on the road or in the office is the whole issue of fitting in the time to type up the notes and perform the activities you’ve agreed, before the next meeting starts.

It means I can still send my emails from Outlook, access documents from our Cloud, check my calendar, access anything on my desktop, use Word etc, with exactly the same look and function as if I was on a PC. The other ‘plus’ is that it’s all in the same place, which saves going in and out of various Apps. It is certainly a long way from when I first got an iPad, and you couldn’t use Microsoft programmes at all, or at least it certainly wasn’t easy to do so! I can’t imagine ever going back to a laptop now, let alone a PC!!

It means I can still send my emails from Outlook, access documents from our Cloud, check my calendar, access anything on my desktop, use Word etc, with exactly the same look and function as if I was on a PC. The other ‘plus’ is that it’s all in the same place, which saves going in and out of various Apps. It is certainly a long way from when I first got an iPad, and you couldn’t use Microsoft programmes at all, or at least it certainly wasn’t easy to do so! I can’t imagine ever going back to a laptop now, let alone a PC!! legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

legal news. Today I was really struck by how Tech focussed the profession is becoming – gone is the image of the lawyer surrounded by paper and difficult to get in touch with.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly.

We have been developing our very own portal, it is a secure method for clients to send their instructions to us and both organisations benefit from a full audit trail, it is extremely user friendly. CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea.

CLT Scotland are now offering e-learning CPD -you can now gain the necessary CPD hours by fitting it into your own schedule, you could even do it from home wearing your pyjamas (if you wished!) Topics include the Criminal Justice (Scotland) Act 2016, powers of attorney and social media law. I really think that CPD without having to leave your desk is a great idea. Fear of change

Fear of change

Lack of skills

Lack of skills Miles Duncan is CEO and Founder

Miles Duncan is CEO and Founder