Effective & Efficient Credit Control with Cashroom

For law firms, efficient credit control is essential to ensure a healthy cash flow, maintain client relationships, and sustain profitability. Handling accounts receivable and managing outstanding invoices can be a complex and time-consuming process. That’s where specialised services like Cashroom come into play, offering valuable support to law firms in managing credit control effectively. Cashroom now offer an automated credit control service. Ensuring you have an effective credit control strategy in place means you shouldn’t need to worry about chasing year old invoices and your fee earners aren’t spending copious amounts of time chasing fees.

Timely Invoicing

One of the key aspects of credit control is sending out invoices promptly. Delayed invoicing can result in delayed payments, affecting your firm’s cash flow. Cashroom ensures that invoices are generated and dispatched in a timely manner through our custom-built client portal. Our dashboard view ensures that clients are well-informed about their financial obligations, reducing the likelihood of disputes or delays in payments.

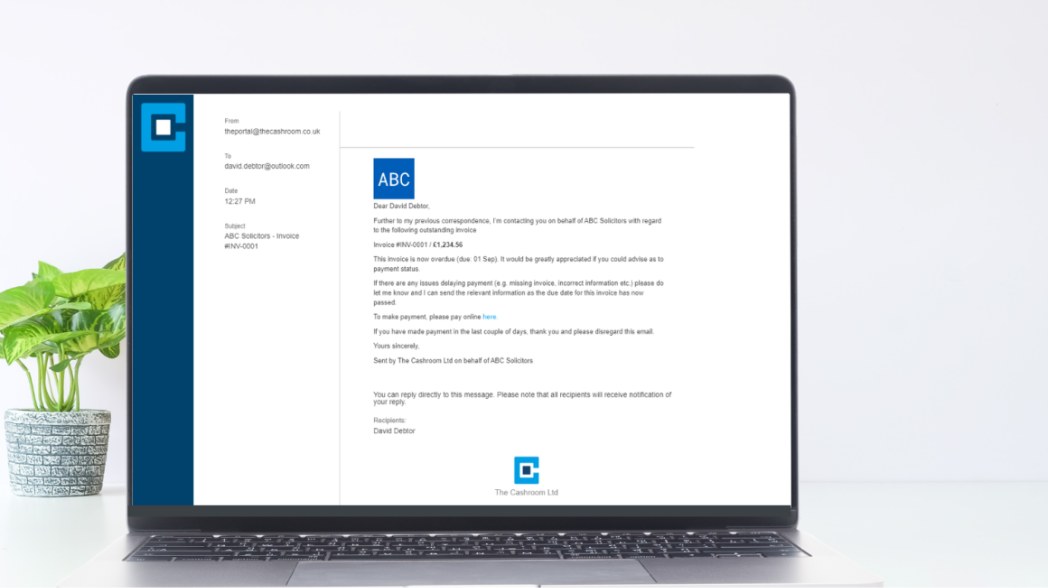

Monitoring and Chasing Outstanding Invoices

Cashroom takes the burden of monitoring and chasing outstanding invoices off your firm’s shoulders. They maintain a vigilant watch over your accounts receivables, sending reminders and escalation notices to clients when necessary. This proactive approach minimizes late payments and disputes and ensures a consistent flow of revenue.

Customised Credit Control Strategies

Cashroom recognises that each law firm has unique credit control needs. That’s why we can tailor a firm’s credit control strategy to align with your specific requirements and client relationships. This level of customisation ensures that your clients are treated with care and respect, even during the credit control process.

Cash Flow Forecasting

Cashroom can also provide law firms with cash flow forecasting and reporting, helping partners and administrators better understand the firm’s financial position. Accurate cash flow forecasting allows firms to plan for their financial future, identify areas of concern, and make informed decisions regarding staffing and investment.

‘‘We’ve been using the Cashroom’s Credit Control module for 4 months now, and it’s wonderful. Funda mentally, it has automated the process for cash recovery and my company relies on it.’

mentally, it has automated the process for cash recovery and my company relies on it.’

Billy Smith Director, Clarity Simplicity

Reduction of Administrative Burden

Outsourcing credit control to Cashroom allows law firms to free up valuable internal resources. This reduction in administrative burden enables lawyers to focus on their core competencies, such as providing legal services to clients, without the distraction of chasing payments and managing the intricacies of credit control. The credit control dashboard view also gives you oversight every step of the way.

Enhanced Client Relationships

Efficient credit control isn’t just about collecting payments; it’s also about maintaining positive client relationships. By outsourcing these tasks to a specialised provider like Cashroom, law firms can ensure that credit control activities are conducted with professionalism and diplomacy, preserving client trust and goodwill. We know what works.

Cashroom’s support in credit control offers a lifeline for law firms seeking to improve their financial health, streamline operations, and enhance client relationships. By outsourcing credit control to specialists who understand the unique challenges of the legal sector, firms can maintain a positive cash flow and continue to provide excellent legal services. As a result, Cashroom has become an invaluable partner for many law firms, helping them navigate the complexities of credit control efficiently and effectively.

End 2023 on a high with Cashroom’s remarkable and efficient credit control solution. To find out more about how our Credit Control packages to support your firm’s operational efficiency and growth, get in touch with our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’