Introducing Confirmation of Payee at Cashroom: A Revolutionary Breakthrough in Secure Financial Transactions.

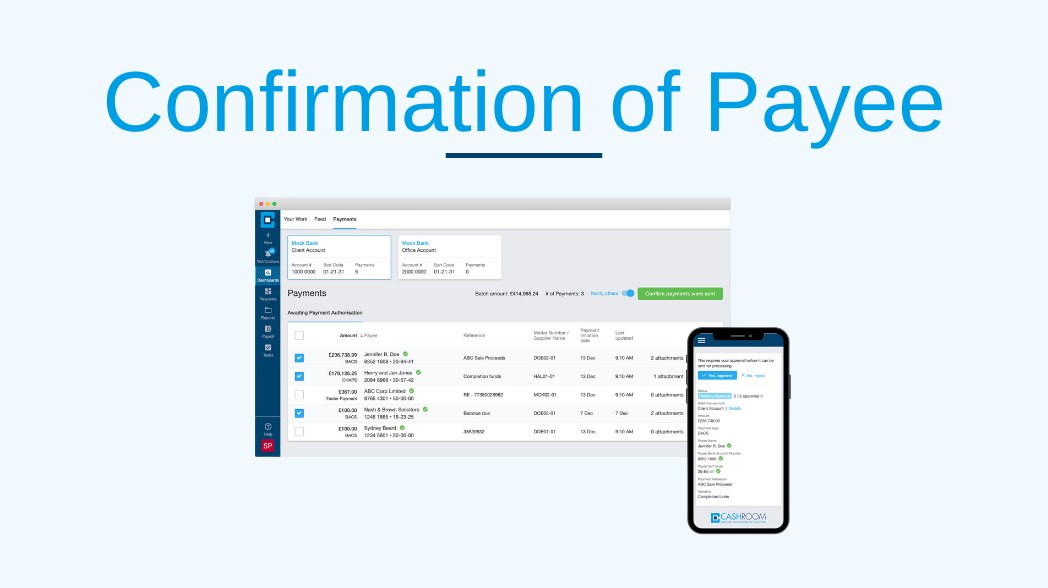

Marking a significant milestone in the legal sector, Cashroom confirms the launch of Confirmation of Payee into their client portal. This development is a first in the legal industry with the revolutionary Confirmation of Payee feature at the forefront of the payment process with Cashroom, who become the first supplier to be able to offer this feature to increase security and efficiency for law firms. All Cashroom clients will have access to this feature in 2024.

Confirmation of Payee (CoP) is a security feature used in financial transactions to verify that the payee’s name matches the information held by the payer’s bank. It is designed to prevent payments from being sent to the wrong account or to fraudulent individuals or entities.

The majority of people will be aware of what Confirmation of Payee checks are. We are all beginning to see these checks daily on our own personal banking apps when sending money and the technology and process Cashroom have created works in a very similar way. The difference being CoP at Cashroom has been designed specifically for law firms to support a streamlined and efficient accounting process.

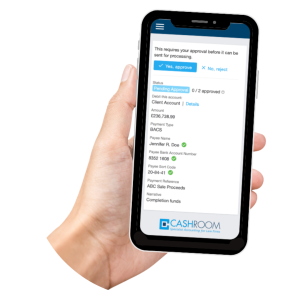

When a payer initiates a payment, the bank or financial institution uses the Confirmation of Payee system to check whether the name provided by the payer matches the name associated with the account details provided by the payee. If there is a mismatch or if the payee’s name cannot be verified, the payer may be alerted to the potential discrepancy, allowing them to verify the details and avoid making an erroneous payment.

Confirmation of Payee is particularly valuable in preventing certain types of fraud, such as authorized push payment (APP) scams, where individuals are tricked into transferring money to fraudulent accounts. By confirming the payee’s identity before processing the payment, CoP adds an extra layer of security to financial transactions.

The banks already do this, so what is the benefit Cashroom clients will have?

By utilizing Cashroom for Confirmation of Payee checks, law firms can eliminate last-minute d elays. Currently, these checks are conducted at the bank as a crucial final step in the payment process. However, performing these checks at such a late stage often leads to frustration and setbacks for both law firms and their clients when there are errors or mistakes found. These issues can be as simple as someone changing their bank account. By conducting these checks at the beginning of the process, potential problems can be identified early on. For instance, in conveyancing chains, completing these checks before the final stages of completion ensures a seamless completion day and provides peace of mind that transactions are ready to proceed. This approach avoids potential delays and prevents clients from waiting on a driveway for a payment to be received.

elays. Currently, these checks are conducted at the bank as a crucial final step in the payment process. However, performing these checks at such a late stage often leads to frustration and setbacks for both law firms and their clients when there are errors or mistakes found. These issues can be as simple as someone changing their bank account. By conducting these checks at the beginning of the process, potential problems can be identified early on. For instance, in conveyancing chains, completing these checks before the final stages of completion ensures a seamless completion day and provides peace of mind that transactions are ready to proceed. This approach avoids potential delays and prevents clients from waiting on a driveway for a payment to be received.

This innovative feature empowers Cashroom clients to effortlessly validate payee names against the sort code and account number when initiating payments through the Cashroom portal. Say goodbye to disruptions and delays caused by inaccurate payment details when uploading to the bank. With the powerful Confirmation of Payee, Cashroom clients can now rest assured knowing that any errors will be promptly detected right from the beginning of the payment process, ultimately saving them valuable time and eliminating unnecessary stress.

Cashroom are currently in the final stages of development and are actively seeking clients to join them in their exclusive BETA testing stages and become part of the testing team. If you are interested in being part of this exciting opportunity as BETA tester, please reach out to Cashroom.

“I’m delighted we have been able to launch this exciting new feature in our platform. This powerful functionality enables our clients to validate payee names against the sort code and account number when setting up payments through the Cashroom portal at the very beginning of the process. In addition to the obvious security and efficiency benefits this feature brings, this feature offers significant benefits in reducing delays in payment processes and eliminates incorrect payments, protecting firms and their clients. Our engineering team at Cashroom are constantly working to innovate and build secure, efficient and risk avoidant features to help our clients ensure compliance and this ground breaking new feature is the latest in a line of integrations as we continue to revolutionise legal accounting.”

Paul O’Day, Chief T echnology Officer, Cashroom

echnology Officer, Cashroom

This remarkable feature will be available to all clients in 2024. Make sure to stay tuned for more updates in the new year from Cashroom.

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’