Empowering the next Generation of Lawyers & Law Firm Leaders

The legal profession is undoubtedly undergoing a transformation period, driven by technological advancements, shifting client expectations and evolving work culture. To empower the next generation of lawyers and law firm leaders, firms must adapt and innovate, addressing critical areas such as hybrid working, wellbeing, personal development and continuous training. In this blog we look at these key areas and how firms can adapt and empower the next generation, ultimately creating a thriving, sustainable and dynamic workforce.

Embracing Hybrid Working

The pandemic has forever altered our perception of the traditional office. Hybrid working models, which combine remote and in-office work, offer flexibility and can enhance productivity. For law firms, adopting a hybrid working structure requires:

- A strong Technological Infrastructure

Invest in secure, reliable technology that supports seamless communication and collaboration. Tools like cloud-based document management systems and virtual meeting platforms are essential.

- Clear Policies

Develop clear hybrid working policies that outline expectations, communication protocols, and performance metrics. Flexibility should be balanced with accountability.

- Work-Life Balance

Encourage a culture that respects boundaries between work and personal life, ensuring lawyers can disconnect and re-charge.

Statistics indicate that employees in hybrid working environments report higher job satisfaction. According to a survey by FlexJobs, 97% of workers desire some form of remote work.

Prioritising Wellbeing

A lawyer’s job is incredibly demanding, both physically and mentally, they often face high stress levels, long hours and intense workloads. Prioritising wellbeing is crucial for maintaining a healthy, productive workforce. To support staff, firms can look at implementing the following:

- Wellbeing Days: Introduce regular wellbeing days where employees can take time off to focus on their mental and physical health. These days can help reduce burnout and improve overall job satisfaction.

- Mental Health Support: Provide access to mental health resources such as counselling services, stress management workshops, and mental health days.

- Wellness Programs: Offer wellness programs that include fitness classes, mindfulness sessions, and ergonomic assessments to promote a holistic approach to health.

Personal Development Programmes

Personal development is key to retaining talent and preparing future leaders. Law firms should create comprehensive personal development plans that include:

- Mentorship Programs: Establish mentorship programs that pair junior lawyers with experienced mentors who can provide guidance, support, and career advice.

- Regular Feedback: Implement a system for regular, constructive feedback that helps lawyers understand their strengths and areas for improvement.

- Career Pathways: Clearly define career progression pathways, providing transparency and opportunities for advancement within the firm.

A LinkedIn report revealed that 94% of employees would stay at a company longer if it invested in their career development.

Invest in continuous training

The legal sector is constantly evolving, and continuous training is essential for lawyers to stay current and competitive. Law firms should focus on:

- Professional Development: Offer regular training sessions on emerging legal trends, new regulations, and technological advancements in the legal field.

- Soft Skills Training: Develop programs that enhance soft skills such as communication, leadership, and negotiation, which are critical for effective lawyering and client relations.

- Cross-Disciplinary Learning: Encourage lawyers to engage in cross-disciplinary learning to broaden their expertise and adaptability. This can include training in business management, finance, or technology.

According to the Association for Talent Development, companies that offer comprehensive training programs have 218% higher income per employee than those without formalised training.

Cultivating a Diverse and Inclusive Culture

Diversity and inclusion are not just buzzwords; they are fundamental to fostering innovation, representing a broad client base and attracting new talent. There are various ways firms can work towards a diverse and inclusive culture, including:

- Diversity Initiatives: Implement diversity initiatives that actively recruit and retain lawyers from diverse backgrounds.

- Inclusive Environment: Create an inclusive work environment where all employees feel valued and respected, regardless of their gender, ethnicity, or background.

- Bias Training: Conduct regular bias training to ensure that unconscious biases do not hinder the progress of any team member.

McKinsey’s research shows that companies in the top quartile for racial and ethnic diversity are 35% more likely to have financial returns above their respective national industry medians.

Empowering the next generation of lawyers and law firm leaders requires a multifaceted approach. By embracing hybrid working, prioritizing wellbeing, fostering personal development, investing in continuous training, and cultivating a diverse and inclusive culture, law firms can build a resilient, forward-thinking workforce that is attractive to the next generation of lawyers and future-proof. The future of law is not just about adapting to change; it’s about leading it.

To keep up to date with all of the latest news and updates from Cashroom, you can sign up to our monthly newsletter here

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

Microsoft Teams, or the Cashroom portal! Document management is also crucial for law firms, adopting a centralised management system can streamline processes and increase efficiency. The SRA (Solicitors Regulatory Authority) found that 75% of UK Law firms have experienced a cyber-attack in the last year, with emails being the primary target. While emails still have a place, we are seeing a shift towards the use of secure client portals for communication which both enhances clients’ experience and ensures security.

Microsoft Teams, or the Cashroom portal! Document management is also crucial for law firms, adopting a centralised management system can streamline processes and increase efficiency. The SRA (Solicitors Regulatory Authority) found that 75% of UK Law firms have experienced a cyber-attack in the last year, with emails being the primary target. While emails still have a place, we are seeing a shift towards the use of secure client portals for communication which both enhances clients’ experience and ensures security.

recording keeping. Non-compliance can result in severe penalties, loss of license and reputational damage.

recording keeping. Non-compliance can result in severe penalties, loss of license and reputational damage.  pen banking, confirmation of payee checks, automated workflows,

pen banking, confirmation of payee checks, automated workflows,  misunderstandings.

misunderstandings.

solutions seamlessly integrate with what your law firm currently uses. This adaptability ensures a smooth transition without the hassle of overhauling existing infrastructures, saving both time and resources for law firms. We use over 30 Practice Management Systems and have no hidden alliance to any – we work with the system that is best for you and your law firm.

solutions seamlessly integrate with what your law firm currently uses. This adaptability ensures a smooth transition without the hassle of overhauling existing infrastructures, saving both time and resources for law firms. We use over 30 Practice Management Systems and have no hidden alliance to any – we work with the system that is best for you and your law firm.  regulations. Clients can rest assured that their data remains secure at all times. Your data is securely stored for up to 7 years and provides a clear audit trail in line with compliance procedures. While other providers may use email communication vulnerable to cyber threats, our secure and encrypted portal is cyber essentials plus certified, providing our clients with peace of mind.

regulations. Clients can rest assured that their data remains secure at all times. Your data is securely stored for up to 7 years and provides a clear audit trail in line with compliance procedures. While other providers may use email communication vulnerable to cyber threats, our secure and encrypted portal is cyber essentials plus certified, providing our clients with peace of mind. tracking capabilities, Cashroom puts control back into the hands of law firms.

tracking capabilities, Cashroom puts control back into the hands of law firms.

g liquidity crunches and enabling firms to operate smoothly.

g liquidity crunches and enabling firms to operate smoothly. s to accurate and up-to-date information enables informed decision-making and timely intervention.

s to accurate and up-to-date information enables informed decision-making and timely intervention.

professionals to maintain a healthy work-life balance, leading to burnout and fatigue.

professionals to maintain a healthy work-life balance, leading to burnout and fatigue.

There is plenty of help available online for coping with mental health, including

There is plenty of help available online for coping with mental health, including

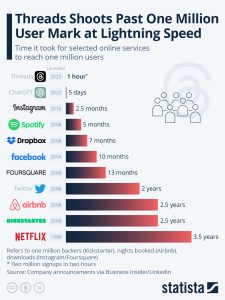

timeline for products to reach 1 million users reveals a notable acceleration over the years. In 1999, Netflix reached this milestone in 3.5 years. In contrast, Chat GBT achieved the same feat within just 5 days of its launch in 2022. Even more impressively, Threads, a competitor to Twitter, attracted 1 million users within an hour of its debut earlier this year. This rapid adoption highlights how consumers are more open to trying new products and quickly change providers if their needs are not met. Threads saw a surge in users, especially following the controversy involving Elon Musk and Twitter. It is likely that many of these 1 million users were former Twitter users looking for an alternative platform. This trend is not only relevant to tech companies but also to businesses and law firms. It is important to recognize that if service quality declines, there are other options available to consumers. Today’s consumers are more willing to explore alternatives than in the past, therefore it is crucial for law firms and businesses to adapt to retain clients and foster loyalty.

timeline for products to reach 1 million users reveals a notable acceleration over the years. In 1999, Netflix reached this milestone in 3.5 years. In contrast, Chat GBT achieved the same feat within just 5 days of its launch in 2022. Even more impressively, Threads, a competitor to Twitter, attracted 1 million users within an hour of its debut earlier this year. This rapid adoption highlights how consumers are more open to trying new products and quickly change providers if their needs are not met. Threads saw a surge in users, especially following the controversy involving Elon Musk and Twitter. It is likely that many of these 1 million users were former Twitter users looking for an alternative platform. This trend is not only relevant to tech companies but also to businesses and law firms. It is important to recognize that if service quality declines, there are other options available to consumers. Today’s consumers are more willing to explore alternatives than in the past, therefore it is crucial for law firms and businesses to adapt to retain clients and foster loyalty.

document analysis, and contract reviews. We are also witnessing the emergence of legal chatbots capable of contesting parking fines and addressing other minor legal issues. While AI-driven case production requires substantial data and effort, it offers informed outputs and analytics that would otherwise take humans hours or even days to produce.

document analysis, and contract reviews. We are also witnessing the emergence of legal chatbots capable of contesting parking fines and addressing other minor legal issues. While AI-driven case production requires substantial data and effort, it offers informed outputs and analytics that would otherwise take humans hours or even days to produce.

e dating- saying you’re 6 foot 2 when you’re a foot shorter than that will not hold up when you actually meet…

e dating- saying you’re 6 foot 2 when you’re a foot shorter than that will not hold up when you actually meet… oach.

oach.

understand the requirements and challenges law firms face with their cashiering and accounting. With this specialised expertise, they can offer tailored solutions to meet the unique needs of each law firm. Their commitment to personalised support means you are guided every step of the way, with peace of mind knowing your finances are entrusted to capable hands. After a thorough and smooth onboarding process, Cashroom ensure each client has a team of cashiers and accountants with specific skills and experience to match their system use and needs. Your cashiering and accounting team at Cashroom become an extended part of your inhouse team, as if they were part of your business.

understand the requirements and challenges law firms face with their cashiering and accounting. With this specialised expertise, they can offer tailored solutions to meet the unique needs of each law firm. Their commitment to personalised support means you are guided every step of the way, with peace of mind knowing your finances are entrusted to capable hands. After a thorough and smooth onboarding process, Cashroom ensure each client has a team of cashiers and accountants with specific skills and experience to match their system use and needs. Your cashiering and accounting team at Cashroom become an extended part of your inhouse team, as if they were part of your business.

pricing software like Virtual Pricing Director® cannot be overstated. It offers detailed insights into performance metrics, financial trends, and client engagement levels, allowing firms to make data-driven decisions.

pricing software like Virtual Pricing Director® cannot be overstated. It offers detailed insights into performance metrics, financial trends, and client engagement levels, allowing firms to make data-driven decisions. pricing software directly contributes to this shift by enabling firms to offer clear, upfront estimates of legal costs, thereby demystifying the billing process.

pricing software directly contributes to this shift by enabling firms to offer clear, upfront estimates of legal costs, thereby demystifying the billing process. specialised legal pricing software into law firm operations will likely become more prevalent. This technology not only addresses the immediate challenges of pricing and financial management but also aligns with the broader trends of digital transformation and client-centric service delivery.

specialised legal pricing software into law firm operations will likely become more prevalent. This technology not only addresses the immediate challenges of pricing and financial management but also aligns with the broader trends of digital transformation and client-centric service delivery.

incentives with the firms’ goals, increases accountability.

incentives with the firms’ goals, increases accountability.

mutual support is key to achieving collective success. Acknowledging both individual accomplishments and collaborative work enhances team unity and promotes a positive workplace atmosphere.

mutual support is key to achieving collective success. Acknowledging both individual accomplishments and collaborative work enhances team unity and promotes a positive workplace atmosphere.

taking on the whole function by themselves and struggling to keep up with regulations, chase payments and manage their accounts. We are all far too familiar with the consequences of burnout, not only for the individual but for the firm. Exhaustion can negatively impact the quality of services delivered to clients and, the toll on mental and physical well-being can have lasting repercussions, both personally and professionally.

taking on the whole function by themselves and struggling to keep up with regulations, chase payments and manage their accounts. We are all far too familiar with the consequences of burnout, not only for the individual but for the firm. Exhaustion can negatively impact the quality of services delivered to clients and, the toll on mental and physical well-being can have lasting repercussions, both personally and professionally.

Despite challenges, I have utilized continuous professional development to excel in my field, actively pursuing leadership opportunities. Leading by example, I advocate for gender equality within my team, ensuring inclusivity and a comfortable environment for all. I am very open with my team that I never want them to feel uncomfortable in any situation.

Despite challenges, I have utilized continuous professional development to excel in my field, actively pursuing leadership opportunities. Leading by example, I advocate for gender equality within my team, ensuring inclusivity and a comfortable environment for all. I am very open with my team that I never want them to feel uncomfortable in any situation.

financial journey and make the most of the opportunity to step back, assess and make meaningful changes that will benefit you and your firm well beyond this extra day.

financial journey and make the most of the opportunity to step back, assess and make meaningful changes that will benefit you and your firm well beyond this extra day.  By leveraging leap day to focus on financial management initiatives, law firms can position themselves for greater success and sustainability for the year ahead. Remember, every day counts when it comes to maximising your financial health and performance!

By leveraging leap day to focus on financial management initiatives, law firms can position themselves for greater success and sustainability for the year ahead. Remember, every day counts when it comes to maximising your financial health and performance!

associated costs linked to poor culture and disengagement. Drawing from my experience as a former head-hunter, I’ve encountered numerous instances where departing candidates disclosed genuine reasons for leaving, such as issues with management, feeling undervalued, or a perceived lack of career progression. Regrettably, many companies overlook the valuable opportunity presented by exit interviews, neglecting a deeper understanding of the employee experience.

associated costs linked to poor culture and disengagement. Drawing from my experience as a former head-hunter, I’ve encountered numerous instances where departing candidates disclosed genuine reasons for leaving, such as issues with management, feeling undervalued, or a perceived lack of career progression. Regrettably, many companies overlook the valuable opportunity presented by exit interviews, neglecting a deeper understanding of the employee experience.

should continue to learn about it and as a bare minimum should seek to stay aware of what their competitors are doing.

should continue to learn about it and as a bare minimum should seek to stay aware of what their competitors are doing.