Empowering the next Generation of Lawyers & Law Firm Leaders

The legal profession is undoubtedly undergoing a transformation period, driven by technological advancements, shifting client expectations and evolving work culture. To empower the next generation of lawyers and law firm leaders, firms must adapt and innovate, addressing critical areas such as hybrid working, wellbeing, personal development and continuous training. In this blog we look at these key areas and how firms can adapt and empower the next generation, ultimately creating a thriving, sustainable and dynamic workforce.

Embracing Hybrid Working

The pandemic has forever altered our perception of the traditional office. Hybrid working models, which combine remote and in-office work, offer flexibility and can enhance productivity. For law firms, adopting a hybrid working structure requires:

- A strong Technological Infrastructure

Invest in secure, reliable technology that supports seamless communication and collaboration. Tools like cloud-based document management systems and virtual meeting platforms are essential.

- Clear Policies

Develop clear hybrid working policies that outline expectations, communication protocols, and performance metrics. Flexibility should be balanced with accountability.

- Work-Life Balance

Encourage a culture that respects boundaries between work and personal life, ensuring lawyers can disconnect and re-charge.

Statistics indicate that employees in hybrid working environments report higher job satisfaction. According to a survey by FlexJobs, 97% of workers desire some form of remote work.

Prioritising Wellbeing

A lawyer’s job is incredibly demanding, both physically and mentally, they often face high stress levels, long hours and intense workloads. Prioritising wellbeing is crucial for maintaining a healthy, productive workforce. To support staff, firms can look at implementing the following:

- Wellbeing Days: Introduce regular wellbeing days where employees can take time off to focus on their mental and physical health. These days can help reduce burnout and improve overall job satisfaction.

- Mental Health Support: Provide access to mental health resources such as counselling services, stress management workshops, and mental health days.

- Wellness Programs: Offer wellness programs that include fitness classes, mindfulness sessions, and ergonomic assessments to promote a holistic approach to health.

Personal Development Programmes

Personal development is key to retaining talent and preparing future leaders. Law firms should create comprehensive personal development plans that include:

- Mentorship Programs: Establish mentorship programs that pair junior lawyers with experienced mentors who can provide guidance, support, and career advice.

- Regular Feedback: Implement a system for regular, constructive feedback that helps lawyers understand their strengths and areas for improvement.

- Career Pathways: Clearly define career progression pathways, providing transparency and opportunities for advancement within the firm.

A LinkedIn report revealed that 94% of employees would stay at a company longer if it invested in their career development.

Invest in continuous training

The legal sector is constantly evolving, and continuous training is essential for lawyers to stay current and competitive. Law firms should focus on:

- Professional Development: Offer regular training sessions on emerging legal trends, new regulations, and technological advancements in the legal field.

- Soft Skills Training: Develop programs that enhance soft skills such as communication, leadership, and negotiation, which are critical for effective lawyering and client relations.

- Cross-Disciplinary Learning: Encourage lawyers to engage in cross-disciplinary learning to broaden their expertise and adaptability. This can include training in business management, finance, or technology.

According to the Association for Talent Development, companies that offer comprehensive training programs have 218% higher income per employee than those without formalised training.

Cultivating a Diverse and Inclusive Culture

Diversity and inclusion are not just buzzwords; they are fundamental to fostering innovation, representing a broad client base and attracting new talent. There are various ways firms can work towards a diverse and inclusive culture, including:

- Diversity Initiatives: Implement diversity initiatives that actively recruit and retain lawyers from diverse backgrounds.

- Inclusive Environment: Create an inclusive work environment where all employees feel valued and respected, regardless of their gender, ethnicity, or background.

- Bias Training: Conduct regular bias training to ensure that unconscious biases do not hinder the progress of any team member.

McKinsey’s research shows that companies in the top quartile for racial and ethnic diversity are 35% more likely to have financial returns above their respective national industry medians.

Empowering the next generation of lawyers and law firm leaders requires a multifaceted approach. By embracing hybrid working, prioritizing wellbeing, fostering personal development, investing in continuous training, and cultivating a diverse and inclusive culture, law firms can build a resilient, forward-thinking workforce that is attractive to the next generation of lawyers and future-proof. The future of law is not just about adapting to change; it’s about leading it.

To keep up to date with all of the latest news and updates from Cashroom, you can sign up to our monthly newsletter here

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

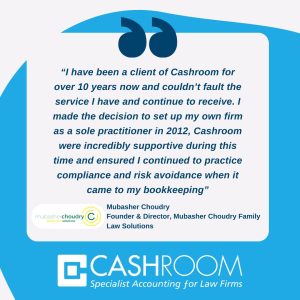

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

7,000 law firm users, is designed to deliver a unique, secure, and exceptional service through its 400 request types, automated tasks, workflows, and authorization processes tailored to each specific request.

7,000 law firm users, is designed to deliver a unique, secure, and exceptional service through its 400 request types, automated tasks, workflows, and authorization processes tailored to each specific request. unique authorization workflows, mandatory fields for request submission, and compliance with the Solicitors Accounts Rules. Not only does this ensure the provision of necessary information, but it also facilitates encrypted communication between Cashroom and our clients, while offering excellent task management capabilities.

unique authorization workflows, mandatory fields for request submission, and compliance with the Solicitors Accounts Rules. Not only does this ensure the provision of necessary information, but it also facilitates encrypted communication between Cashroom and our clients, while offering excellent task management capabilities. providing ongoing training and development opportunities. This commitment to excellence is what sets our cashiers apart, ensuring that they are qualified or in the process of obtaining qualifications. This academy enables us to better support our teams, ensuring the delivery of crucial and exceptional service.

providing ongoing training and development opportunities. This commitment to excellence is what sets our cashiers apart, ensuring that they are qualified or in the process of obtaining qualifications. This academy enables us to better support our teams, ensuring the delivery of crucial and exceptional service. A key focus is efficiency, and agreeing processes with clients that are optimal, calling upon our extensive experience of dealing with a wide variety of firms and systems. We know what works well!

A key focus is efficiency, and agreeing processes with clients that are optimal, calling upon our extensive experience of dealing with a wide variety of firms and systems. We know what works well!

Far too many have old and creaky systems which don’t give the resilience, agility and security that more modern systems can provide. However, even those firms who have traded up and obtained a quality PMS often do not maximise the potential of the system with proper implementation.

Far too many have old and creaky systems which don’t give the resilience, agility and security that more modern systems can provide. However, even those firms who have traded up and obtained a quality PMS often do not maximise the potential of the system with proper implementation. Happy clients make for happier staff and repeat business as well as powerful testimonials and reviews.

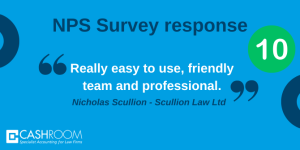

Happy clients make for happier staff and repeat business as well as powerful testimonials and reviews.

People are searching for legal services online, and if your law firm doesn’t appear in the search results, you are absolutely missing out on potential clients. This is why search engine optimisation is so important. If your competitors are investing resources in their SEO, it’s likely that they will be showing up for search terms you also want to rank for and your firm will therefore be losing out on enquiries.

People are searching for legal services online, and if your law firm doesn’t appear in the search results, you are absolutely missing out on potential clients. This is why search engine optimisation is so important. If your competitors are investing resources in their SEO, it’s likely that they will be showing up for search terms you also want to rank for and your firm will therefore be losing out on enquiries.

Outsourcing your finance function is a big decision for firms, that’s why we have collated a list of our frequently asked questions to help. Outsourcing your finance function doesn’t need to be daunting, the process is simple and can save your firm time, money and significantly reduce risk.

Outsourcing your finance function is a big decision for firms, that’s why we have collated a list of our frequently asked questions to help. Outsourcing your finance function doesn’t need to be daunting, the process is simple and can save your firm time, money and significantly reduce risk.

You would have your own dedicated team who operate remotely as an extension of your firm. They communicate with you via our secure client portal, acting on your instructions in real time. They will make postings, reconcile accounts, set up payments, run your payroll, or produce detailed management accounts for you as part of an efficient, compliant and secure service. Our teams are encouraged to develop strong working relationships with our clients, so that they

You would have your own dedicated team who operate remotely as an extension of your firm. They communicate with you via our secure client portal, acting on your instructions in real time. They will make postings, reconcile accounts, set up payments, run your payroll, or produce detailed management accounts for you as part of an efficient, compliant and secure service. Our teams are encouraged to develop strong working relationships with our clients, so that they

At Cashroom, we place a great importance on compliance with Solicitors Accounts Rules and your regulators. You can be confident your accounts are of a high standard and exceed compliance guidelines when outsourcing your finance function to Cashroom. Furthermore, if you are worried about upcoming audits and your compliance, we can support you with preparation.

At Cashroom, we place a great importance on compliance with Solicitors Accounts Rules and your regulators. You can be confident your accounts are of a high standard and exceed compliance guidelines when outsourcing your finance function to Cashroom. Furthermore, if you are worried about upcoming audits and your compliance, we can support you with preparation.

Spotlight:

Spotlight:

e access to their own firm’s finances, this raw data can be difficult to decipher into meaningful information that can be used to support the business. Management Accounts provides you with detailed information on budgets, cashflow projections, performance analysis and more. Raw data is transformed into easy-to-read visual illustrations that have the power to add value across the entire business. The right and accurate data gives you more control over what is happening in your firm, and the transparency of management accounts gives firms more control, allows for better strategy planning and helps avoid penalties. This information supports organisational growth and stakeholder management. On top of this, transparency is valued by clients, strengthening client relationships and engaging new ones.

e access to their own firm’s finances, this raw data can be difficult to decipher into meaningful information that can be used to support the business. Management Accounts provides you with detailed information on budgets, cashflow projections, performance analysis and more. Raw data is transformed into easy-to-read visual illustrations that have the power to add value across the entire business. The right and accurate data gives you more control over what is happening in your firm, and the transparency of management accounts gives firms more control, allows for better strategy planning and helps avoid penalties. This information supports organisational growth and stakeholder management. On top of this, transparency is valued by clients, strengthening client relationships and engaging new ones. Management accounts helps firms to manage their cashflow more efficiently, by the creation of budgets and forecasts, supporting firms’ growth. As well as budgeting and cashflow, Management Accounts also identifies areas in which firms can improve efficiency and reduce costs.

Management accounts helps firms to manage their cashflow more efficiently, by the creation of budgets and forecasts, supporting firms’ growth. As well as budgeting and cashflow, Management Accounts also identifies areas in which firms can improve efficiency and reduce costs.  Management Accounts provides information to support your firm in improving overall performance. Calculations are made from time spent on clients’ tasks as well as identifying inefficiencies and time-wasting tasks. This in turn helps firms avoid bookkeeping and accounting problems by reducing the risk of overbilling and underbilling clients for work, which not only saves firms time and effort, but contributes to client satisfaction.

Management Accounts provides information to support your firm in improving overall performance. Calculations are made from time spent on clients’ tasks as well as identifying inefficiencies and time-wasting tasks. This in turn helps firms avoid bookkeeping and accounting problems by reducing the risk of overbilling and underbilling clients for work, which not only saves firms time and effort, but contributes to client satisfaction.