Clarity, Openness, and Engagement

Any strategy designed to create long term; happy client relationships has to start way before the client becomes a client.

For any relationship to work there must be a meeting of minds and that means that what you say you are, you must be. Your messaging on your website, in adverts, in any interaction designed to attract a potential client, has to be clear and accurate. Your engagement with the prospect needs to be candid and open, and any discussions must be followed up with a confirmation email or letter setting out what is being agreed, clearly and specifically. This must then be reflected in the contract, or engagement terms.

The point is- if you bring onboard a client and there is mismatch of expectation, you are setting that relationship up for trouble. It’s like onlin e dating- saying you’re 6 foot 2 when you’re a foot shorter than that will not hold up when you actually meet…

e dating- saying you’re 6 foot 2 when you’re a foot shorter than that will not hold up when you actually meet…

So, you’ve agreed things clearly and confirmed the terms- next thing is to deliver on promises made. And that goes for both parties- don’t be afraid to speak with your client early on if they are doing things which cut across your agreement. If those things slide and become the accepted norm, it’s very difficult subsequently to pull them up and get things re-established.

In that respect- are your people empowered to call such things out? Do you encourage engagement not just for such procedural monitoring, but also for generally friendly and constructive reasons?

We now have around 140 staff which gives us a sizeable cohort for processing our clients’ work. It’s great for resilience of service, but we do ensure that each client has their own specific small team. It’s not a faceless machine, and having interactions between specific individuals and the client makes everything better. Everything. There’s give and take on both sides, because there is an actual relationship. These engagements can be ad hoc as part of day to day interaction, but they should also be regular, more formal engagements. Review meetings- they can be brief but are so important in building that longer term appr oach.

oach.

We survey our clients for an NPS score. We chat with them about service. About any issues. About the things we are doing really well. We understand their ambitions and aims, and as a result can often upsell other or increased services.

We have clients who have been with us since day one, 15 years ago. It’s because we’ve learnt that these relationships, just like in life, need clarity, openness, and engagement.

Alex Holt, Chief Revenue Officer, The Cashroom

Follow us on LinkedIn

To keep up to date with all of the latest news and updates from Cashroom, you can sign up to our monthly newsletter here

Get in touch to arrange a confidential chat with a member of our team.

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

understand the requirements and challenges law firms face with their cashiering and accounting. With this specialised expertise, they can offer tailored solutions to meet the unique needs of each law firm. Their commitment to personalised support means you are guided every step of the way, with peace of mind knowing your finances are entrusted to capable hands. After a thorough and smooth onboarding process, Cashroom ensure each client has a team of cashiers and accountants with specific skills and experience to match their system use and needs. Your cashiering and accounting team at Cashroom become an extended part of your inhouse team, as if they were part of your business.

understand the requirements and challenges law firms face with their cashiering and accounting. With this specialised expertise, they can offer tailored solutions to meet the unique needs of each law firm. Their commitment to personalised support means you are guided every step of the way, with peace of mind knowing your finances are entrusted to capable hands. After a thorough and smooth onboarding process, Cashroom ensure each client has a team of cashiers and accountants with specific skills and experience to match their system use and needs. Your cashiering and accounting team at Cashroom become an extended part of your inhouse team, as if they were part of your business.

pricing software like Virtual Pricing Director® cannot be overstated. It offers detailed insights into performance metrics, financial trends, and client engagement levels, allowing firms to make data-driven decisions.

pricing software like Virtual Pricing Director® cannot be overstated. It offers detailed insights into performance metrics, financial trends, and client engagement levels, allowing firms to make data-driven decisions. pricing software directly contributes to this shift by enabling firms to offer clear, upfront estimates of legal costs, thereby demystifying the billing process.

pricing software directly contributes to this shift by enabling firms to offer clear, upfront estimates of legal costs, thereby demystifying the billing process. specialised legal pricing software into law firm operations will likely become more prevalent. This technology not only addresses the immediate challenges of pricing and financial management but also aligns with the broader trends of digital transformation and client-centric service delivery.

specialised legal pricing software into law firm operations will likely become more prevalent. This technology not only addresses the immediate challenges of pricing and financial management but also aligns with the broader trends of digital transformation and client-centric service delivery.

incentives with the firms’ goals, increases accountability.

incentives with the firms’ goals, increases accountability.

mutual support is key to achieving collective success. Acknowledging both individual accomplishments and collaborative work enhances team unity and promotes a positive workplace atmosphere.

mutual support is key to achieving collective success. Acknowledging both individual accomplishments and collaborative work enhances team unity and promotes a positive workplace atmosphere.

Despite challenges, I have utilized continuous professional development to excel in my field, actively pursuing leadership opportunities. Leading by example, I advocate for gender equality within my team, ensuring inclusivity and a comfortable environment for all. I am very open with my team that I never want them to feel uncomfortable in any situation.

Despite challenges, I have utilized continuous professional development to excel in my field, actively pursuing leadership opportunities. Leading by example, I advocate for gender equality within my team, ensuring inclusivity and a comfortable environment for all. I am very open with my team that I never want them to feel uncomfortable in any situation.

financial journey and make the most of the opportunity to step back, assess and make meaningful changes that will benefit you and your firm well beyond this extra day.

financial journey and make the most of the opportunity to step back, assess and make meaningful changes that will benefit you and your firm well beyond this extra day.  By leveraging leap day to focus on financial management initiatives, law firms can position themselves for greater success and sustainability for the year ahead. Remember, every day counts when it comes to maximising your financial health and performance!

By leveraging leap day to focus on financial management initiatives, law firms can position themselves for greater success and sustainability for the year ahead. Remember, every day counts when it comes to maximising your financial health and performance!

associated costs linked to poor culture and disengagement. Drawing from my experience as a former head-hunter, I’ve encountered numerous instances where departing candidates disclosed genuine reasons for leaving, such as issues with management, feeling undervalued, or a perceived lack of career progression. Regrettably, many companies overlook the valuable opportunity presented by exit interviews, neglecting a deeper understanding of the employee experience.

associated costs linked to poor culture and disengagement. Drawing from my experience as a former head-hunter, I’ve encountered numerous instances where departing candidates disclosed genuine reasons for leaving, such as issues with management, feeling undervalued, or a perceived lack of career progression. Regrettably, many companies overlook the valuable opportunity presented by exit interviews, neglecting a deeper understanding of the employee experience.

should continue to learn about it and as a bare minimum should seek to stay aware of what their competitors are doing.

should continue to learn about it and as a bare minimum should seek to stay aware of what their competitors are doing.

T

T

solutions, legal professionals can simplify their workflows, decrease the amount of time spent on administrative duties, and concentrate on the intricacies of their cases.

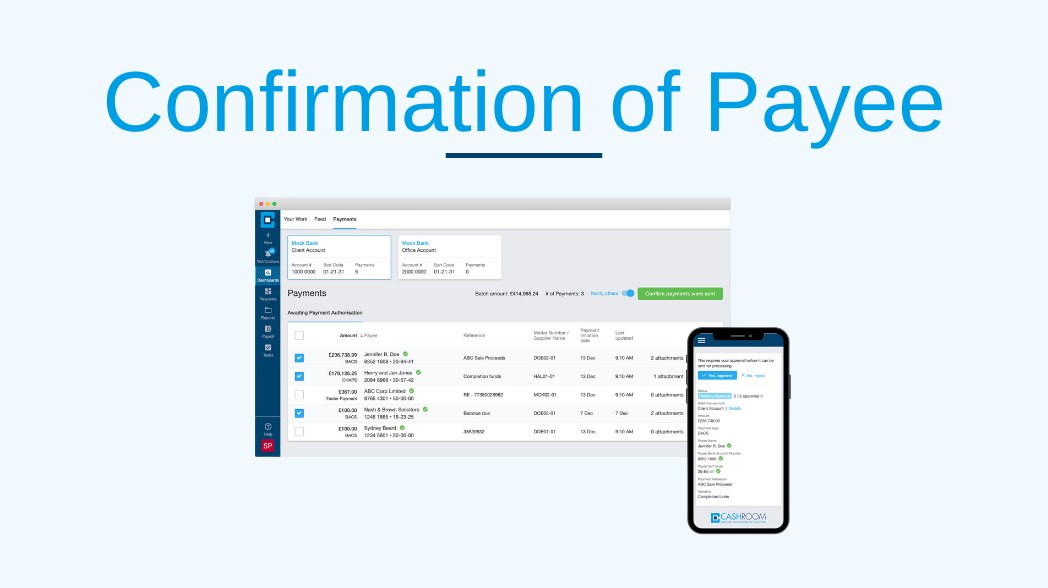

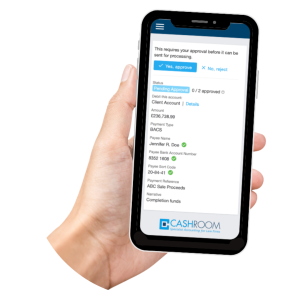

solutions, legal professionals can simplify their workflows, decrease the amount of time spent on administrative duties, and concentrate on the intricacies of their cases.  ensure compliance and reduce risk for our clients. You can read more about this brand-new feature here.

ensure compliance and reduce risk for our clients. You can read more about this brand-new feature here.

echnology Officer, Cashroom

echnology Officer, Cashroom

professionals, as well as investing in the latest financial technologies. The cost-effectiveness enables firms to allocate resources more strategically, investing in areas that directly contribute to their own service offering.

professionals, as well as investing in the latest financial technologies. The cost-effectiveness enables firms to allocate resources more strategically, investing in areas that directly contribute to their own service offering.

financial data, identify trends, and provide insights that guide decision-making. Whether it’s expanding into new practice areas, acquiring other firms, or investing in technology, sound financial analysis and planning are essential for a law firm’s growth and success.

financial data, identify trends, and provide insights that guide decision-making. Whether it’s expanding into new practice areas, acquiring other firms, or investing in technology, sound financial analysis and planning are essential for a law firm’s growth and success.