LEGAL SUPPLIERS GET VOCAL ON CHRISTMAS CHARITY RELEASE

Twenty of the UK’s most reputable suppliers to the legal sector have joined to exercise their vocal talents while raising money for charity by releasing a charity Christmas song.

The Legal Suppliers Chorus is the brainchild of Tom Bailey, managing director of Post Partner, and sees the businesses get together to write, play and sing spoof songs. The Chorus’ first release is a cover of Foo Fighters hit, Times Like These, and will raise funds for The Conveyancing Foundation – a zero-profit registered charity whose purpose is to enhance the lives of those in the conveyancing industry and support fundraising initiatives.

Alongside Tom, the track will feature suppliers, including Armalytix, Best Practice, Bold Legal Group, Cashroom, Ezescan, inCase, IQ Legal Training, Jim Wilson Voice, Legal RSS, Legl, LexRex Communications, Martello App, Minerva, NuForms, Orion Legal Marketing, PEXA, Post Partner, Ricoh and TM Group.

The tongue-in-cheek lyrics explore the trials and tribulations of life in the legal industry.

Speaking of the release, Tom said: “The legal industry is renowned for its ability to both work hard and, when appropriate, let its collective hair down. Its suppliers are no different, and after what has been a tough year in the sector, particularly for those in property and conveyancing, we’re pleased to be raising some money and hopefully a few smiles to round off 2023.”

Funds raised for The Conveyancing Foundation will be donated to several different charities and causes and will contribute to the Foundation’s efforts to support the well-being of those working within the sector.

Lloyd Davies, Managing Director at Convey Law and Chairman of the Conveyancing Foundation, commented: “We endeavour to enhance the lives of those in the property industry and to promote and assist with charity fundraising to help those that need our support.

“Protecting mental health and promoting well-being is a major focus for us; everyone knows that music is a healer. The Legal Suppliers Chorus is a fantastic idea, and having seen the video, I know it’ll provide some welcome entertainment as firms gear up for the Christmas break. We’re very thankful to have been chosen as the charity partner and look forward to the Chorus’ next songs.”

Watch the video here

Donate & Subscribe here

Contact us to find out more about Cashroom

P: 01695 550950

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

‘The Cashroom have been an integral part of MBM from their inception. They has supported the growth of MBM from a small firm of 15 people all the way to the 70+ partners and staff now working in the firm. I have first hand experience of the wealth of skill employed within the business and the cashiering knowledge is unrivalled. The fluid ability of Cashroom to adapt to the changing requirements of a firm on a daily basis, as well as the ability to cover holiday periods seamlessly would be a benefit to any law firm. The Cashroom portal provides a first class workflow system for all cashiering requests and, more importantly, provides the level of security that email instructions do not. Cashroom provide both a cost effective fully outsourced service that can deliver almost everything that an internal finance team would be charged with, as well as a wraparound service to support an internal finance team.’

financial data, identify trends, and provide insights that guide decision-making. Whether it’s expanding into new practice areas, acquiring other firms, or investing in technology, sound financial analysis and planning are essential for a law firm’s growth and success.

financial data, identify trends, and provide insights that guide decision-making. Whether it’s expanding into new practice areas, acquiring other firms, or investing in technology, sound financial analysis and planning are essential for a law firm’s growth and success.

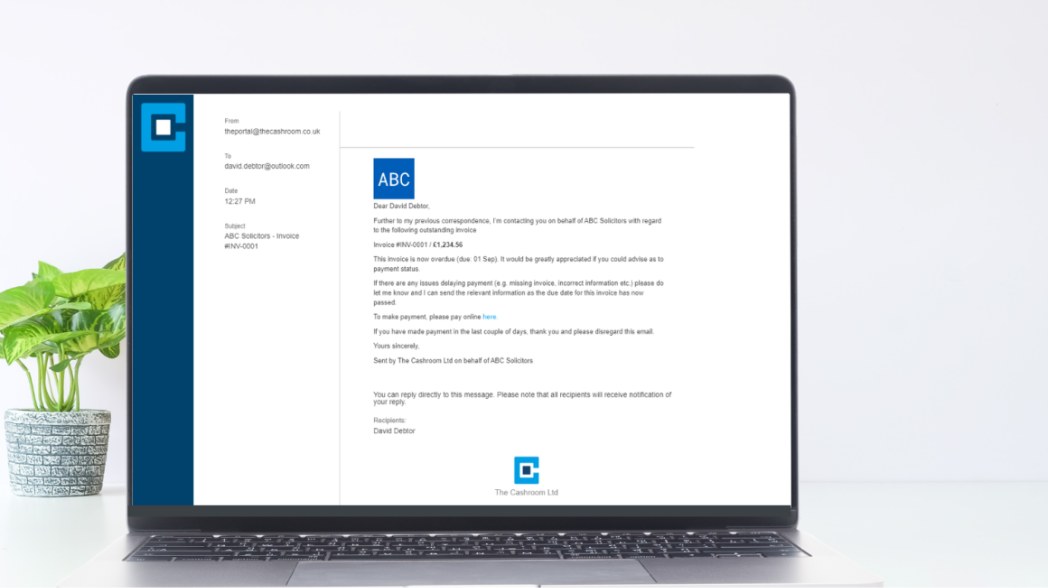

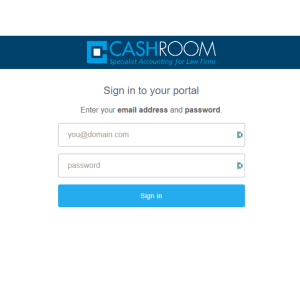

7,000 law firm users, is designed to deliver a unique, secure, and exceptional service through its 400 request types, automated tasks, workflows, and authorization processes tailored to each specific request.

7,000 law firm users, is designed to deliver a unique, secure, and exceptional service through its 400 request types, automated tasks, workflows, and authorization processes tailored to each specific request. unique authorization workflows, mandatory fields for request submission, and compliance with the Solicitors Accounts Rules. Not only does this ensure the provision of necessary information, but it also facilitates encrypted communication between Cashroom and our clients, while offering excellent task management capabilities.

unique authorization workflows, mandatory fields for request submission, and compliance with the Solicitors Accounts Rules. Not only does this ensure the provision of necessary information, but it also facilitates encrypted communication between Cashroom and our clients, while offering excellent task management capabilities. providing ongoing training and development opportunities. This commitment to excellence is what sets our cashiers apart, ensuring that they are qualified or in the process of obtaining qualifications. This academy enables us to better support our teams, ensuring the delivery of crucial and exceptional service.

providing ongoing training and development opportunities. This commitment to excellence is what sets our cashiers apart, ensuring that they are qualified or in the process of obtaining qualifications. This academy enables us to better support our teams, ensuring the delivery of crucial and exceptional service. A key focus is efficiency, and agreeing processes with clients that are optimal, calling upon our extensive experience of dealing with a wide variety of firms and systems. We know what works well!

A key focus is efficiency, and agreeing processes with clients that are optimal, calling upon our extensive experience of dealing with a wide variety of firms and systems. We know what works well!