Sharing the love for our Partners

In the spirit of Valentine’s day this week, we are sharing our love for some of our partners who we value at Cashroom. Our partners not only make our lives a lot easier, but also the lives of our clients.

We believe that when you work with other people, magic happens.

Our unique and dynamic portal

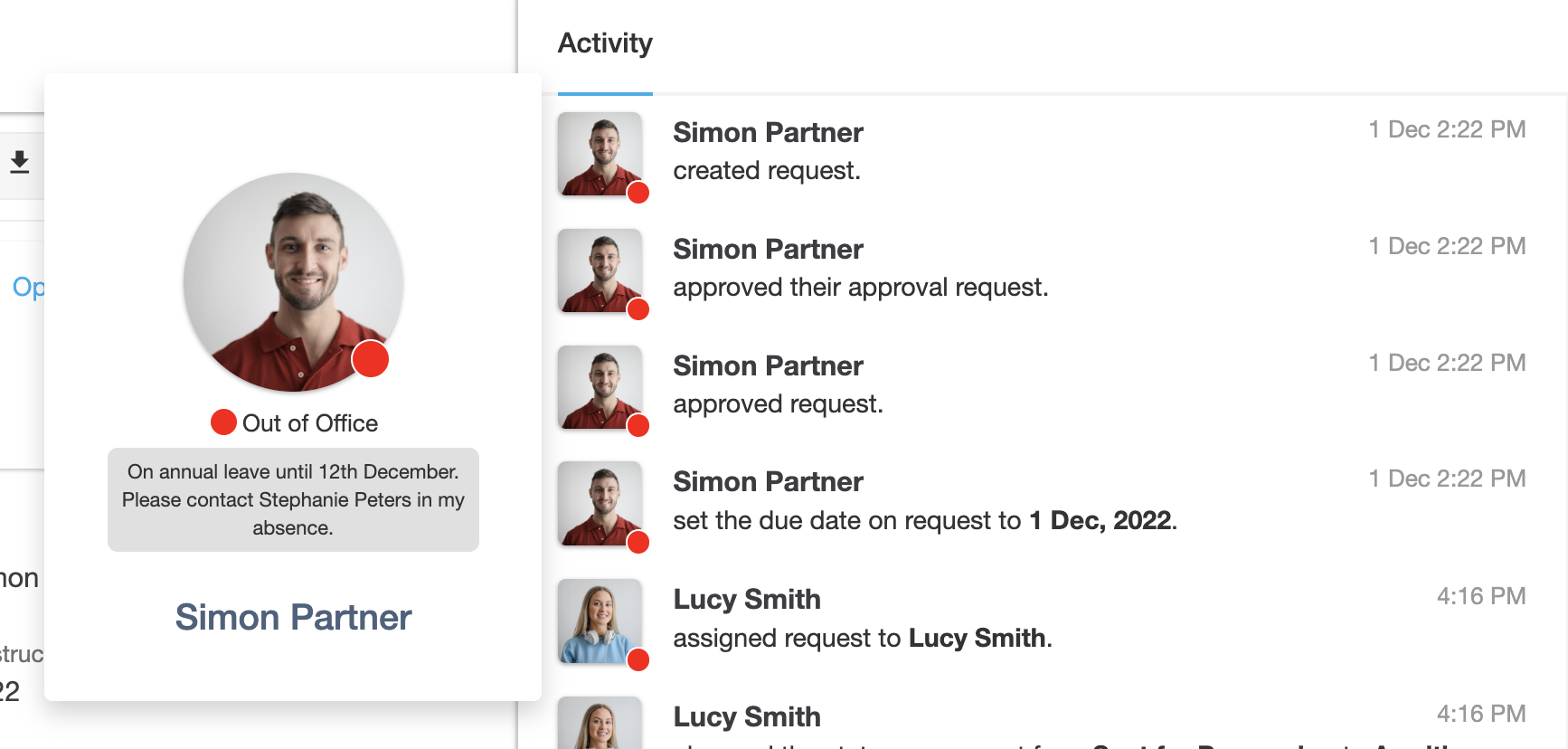

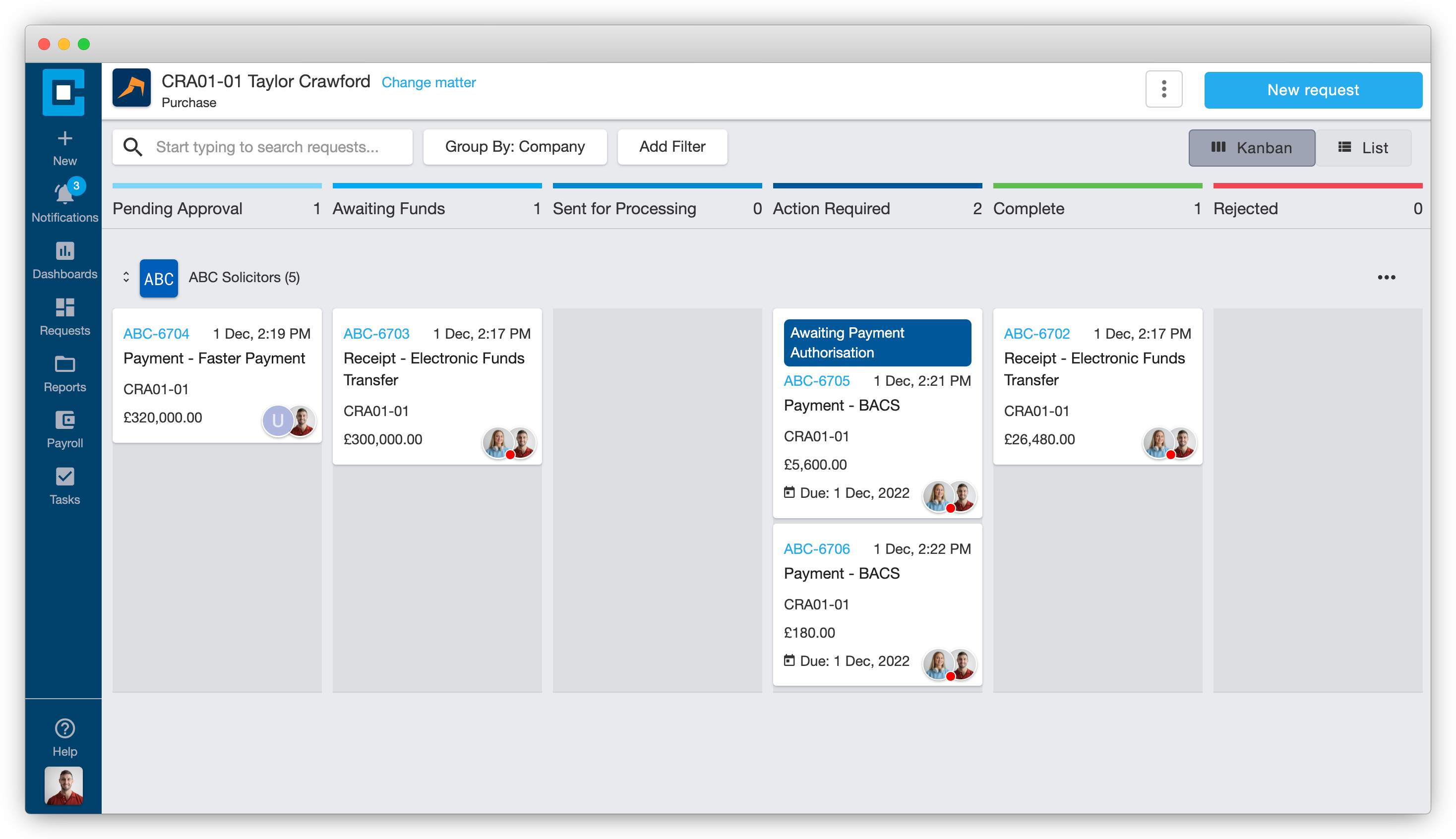

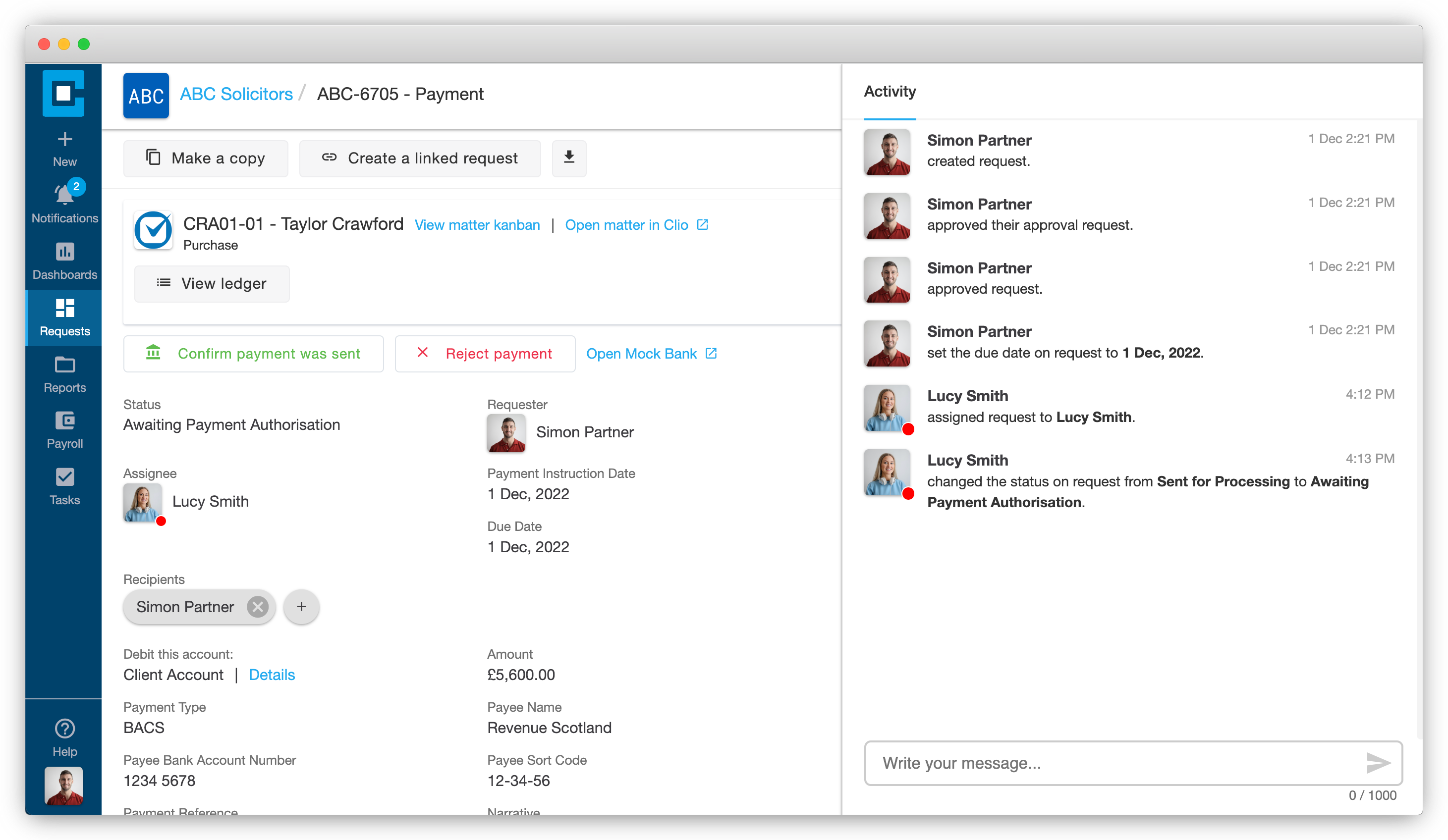

Our partners allow our portal to run even more efficiently to support our clients. Our portal has been built entirely in-house for law firms by our development team. Removing the insecurities of email communication, reducing risk and ensuring a clear audit trail.

We have also added features such as communication tracking, a reports centre, approval options and an unclaimed monies dashboard to support our clients further with their finance functions. Providing clients with the ability to see funds received and claim what belongs to their clients, increase productivity and audit readiness. With Cashroom’s portal, firms can discuss a request within one area without multiple requests or email chains regarding the same discussion point which can become confusing.

Our portal was developed with law firms in mind, and we recently have an added suggestion function for clients to help us continuously develop the portal in line with their needs.

We have also recently introduced open banking to our client portal, streamlining processes further.

Practice Management System Integration Partners

With integrations into leading Practice Management Systems and the banking network, Cashroom allows your law firms tools to work better by integrating with industry leading software and custom applications right into our Cashroom Portal.

Although we are system agnostic and will work with any practice management system a firm is currently using, there are additional benefits for our integrated partners clients with more streamlined workflows, time saving and reduction in duplication of data.

Our integration partners help us to drive efficiency, ensure compliance and reduce risk for our clients.

Banking Partners

With the help of our banking partners, Cashroom can significantly reduce risk of human error when initiating payments and checking for incoming forms.

With open banking technology we can now automatically pull bank transactions into the portal without the need to log onto the Banking platform. While some other entities can pull this data every 24 hours or so, no one else has yet been able to develop technology to do this in close to real time.

If you are interested in sharing the love and integrating with Cashroom, get in touch with our Technology team. Email info@thecashroom.co.uk.

Cashroom friends and publications

We love working with our Cashroom friends and favourite publications in the legal space. The legal sector truly is a sector that pulls together and supports one another. Our favourite legal news comes from Today’s Conveyancer, Hey Legal, Modern Law, Legal Futures, Law Society of Scotland and Bold Legal.

We are also proud to be part of legal networking groups such as Consortium of Professional Advisors, Law Firm Ambition and National Legal Alliance.

Happy Valentine’s Day – Competition time!

We have a Cashroom Valentine’s Day hamper up for grabs! Show your appreciation for a colleague, connection or friend in the industry who deserves a treat! All you need to do is share this blog, tag your nominee and Cashroom and hashtag #CashroomCares. We will reveal the winner on Tuesday 21st February!

About Cashroom

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

Cashroom provides expert outsourced accounting services for Law Firms including Legal Cashiering, Management Accounts and Payroll services. Our mission is to free lawyers from the complexities of legal accounting by supporting the industry with accurate management information and allowing lawyers to do what they do best – practice law.

We’ve been with Cashroom for quite a few years now, and I would never go back. In any business, and particularly in times of uncertainty, it’s important to control your costs, and that’s exactly what you help me do.

Then it was back onto the streets to wander along to a venue near St Paul’s for a quick meeting with

Then it was back onto the streets to wander along to a venue near St Paul’s for a quick meeting with

e access to their own firm’s finances, this raw data can be difficult to decipher into meaningful information that can be used to support the business. Management Accounts provides you with detailed information on budgets, cashflow projections, performance analysis and more. Raw data is transformed into easy-to-read visual illustrations that have the power to add value across the entire business. The right and accurate data gives you more control over what is happening in your firm, and the transparency of management accounts gives firms more control, allows for better strategy planning and helps avoid penalties. This information supports organisational growth and stakeholder management. On top of this, transparency is valued by clients, strengthening client relationships and engaging new ones.

e access to their own firm’s finances, this raw data can be difficult to decipher into meaningful information that can be used to support the business. Management Accounts provides you with detailed information on budgets, cashflow projections, performance analysis and more. Raw data is transformed into easy-to-read visual illustrations that have the power to add value across the entire business. The right and accurate data gives you more control over what is happening in your firm, and the transparency of management accounts gives firms more control, allows for better strategy planning and helps avoid penalties. This information supports organisational growth and stakeholder management. On top of this, transparency is valued by clients, strengthening client relationships and engaging new ones. Management accounts helps firms to manage their cashflow more efficiently, by the creation of budgets and forecasts, supporting firms’ growth. As well as budgeting and cashflow, Management Accounts also identifies areas in which firms can improve efficiency and reduce costs.

Management accounts helps firms to manage their cashflow more efficiently, by the creation of budgets and forecasts, supporting firms’ growth. As well as budgeting and cashflow, Management Accounts also identifies areas in which firms can improve efficiency and reduce costs.  Management Accounts provides information to support your firm in improving overall performance. Calculations are made from time spent on clients’ tasks as well as identifying inefficiencies and time-wasting tasks. This in turn helps firms avoid bookkeeping and accounting problems by reducing the risk of overbilling and underbilling clients for work, which not only saves firms time and effort, but contributes to client satisfaction.

Management Accounts provides information to support your firm in improving overall performance. Calculations are made from time spent on clients’ tasks as well as identifying inefficiencies and time-wasting tasks. This in turn helps firms avoid bookkeeping and accounting problems by reducing the risk of overbilling and underbilling clients for work, which not only saves firms time and effort, but contributes to client satisfaction.